Bowim S.A. (BOW.WA) - Polish Net-Net with New Cycle Brewing

Potential Ukraine Peace Deal Play with 63% Insider Ownership, Trading at 76% NCAV, 0.5x P/TBV and 2x EV/EBITDA

Summary

Bowim is one of the largest companies involved in the distribution and processing of steel products. It supplies sheet metal, pipes, profiles, and rebars primarily to construction, infrastructure, and metallurgy customers in Poland.

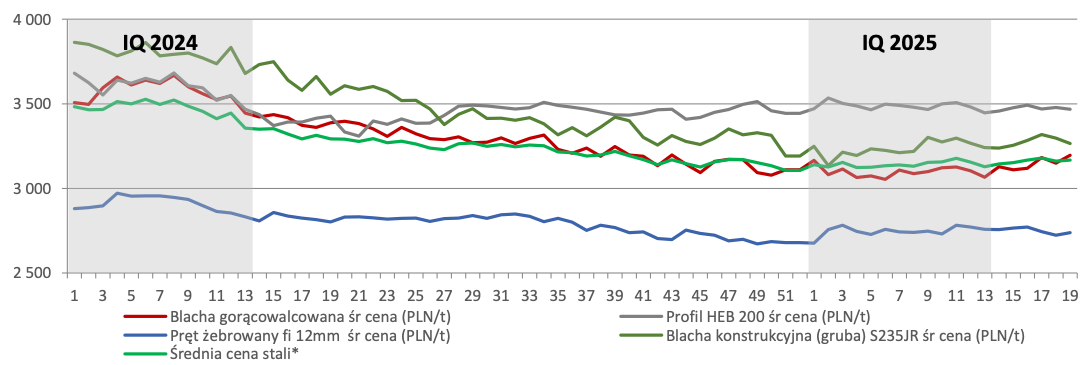

These clients have faced significant volatility in recent years. After a surge in demand in 2021 and 2022, there has been a substantial correction over the last two years. It was mainly due to rising interest rates and slowing demand. Despite this, in 2025, steel product prices began to rise again, increasing by 5-10% across all categories. Interestingly, during the period of declining demand, Bowim was able to capture market share and increase its delivery volumes.

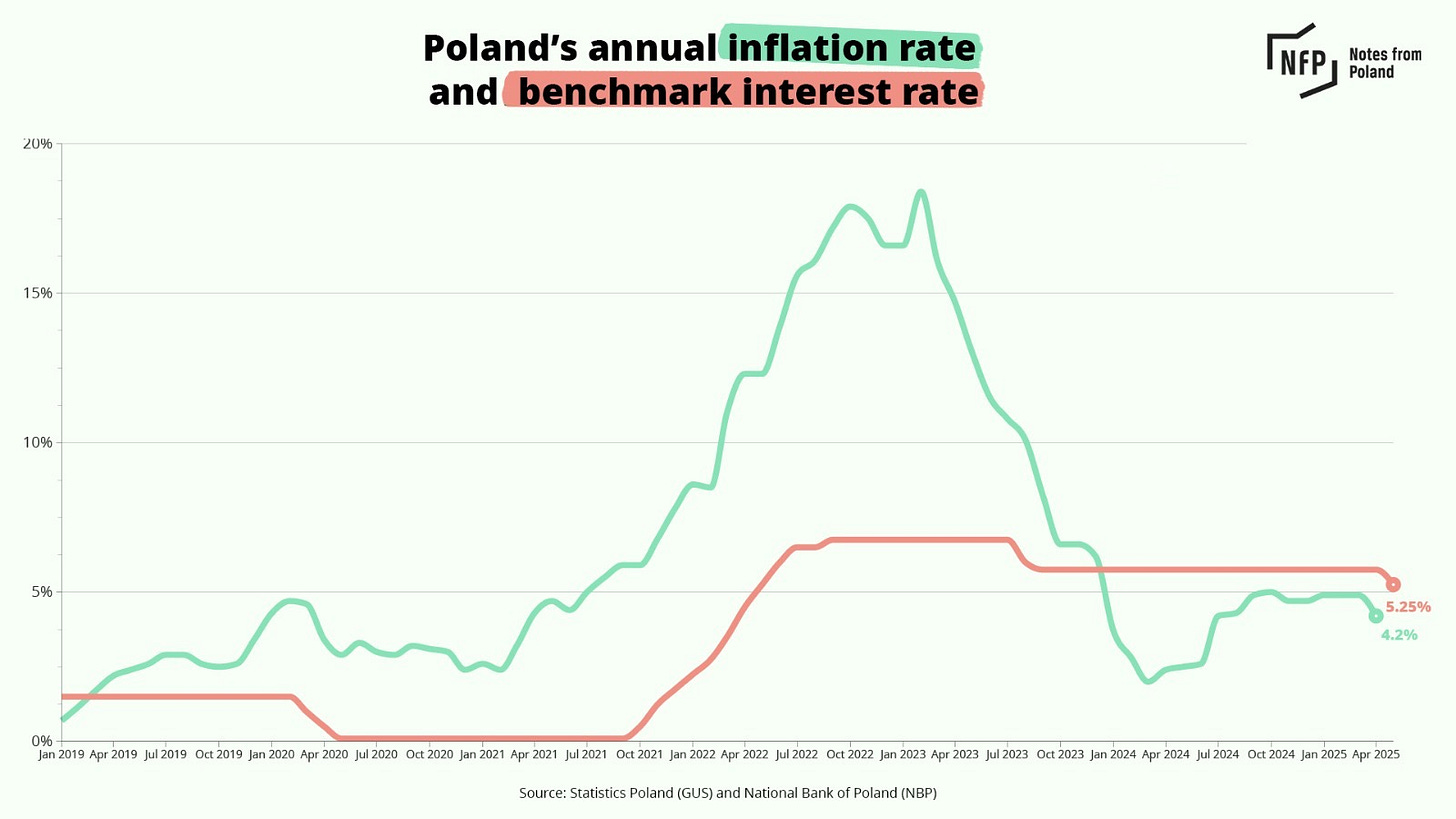

Poland is now entering a historic phase of infrastructure spending, with ambitious targets set for advancements in energy, rail, road, air, and industrial/defense infrastructure. It is estimated that these projects will require over PLN 2 trillion in investments over the next decade (equivalent to 60% of the current GDP) and will necessitate millions of tonnes of raw steel and steel products. Simultaneously, interest rates are beginning to decline again, which should facilitate a resurgence in residential and commercial construction.

Bowim is already a supplier for high-profile projects such as the West Warsaw Railway Station and the Olefin Plock (Petchem Project). With new projects starting every month, it has the potential to become a leading steel supplier for numerous contractors executing these contracts.

Bowim could significantly benefit from a peace deal in Ukraine, as this may lead to a sudden increase in steel demand for rebuilding efforts in the region.

Similar to Valaris (VAL), Bowim has impressive operating leverage, which, if timed correctly with the new cycle, can lead to substantial cash flow generation. During downturns, like in 2024, Bowim may remain barely profitable, but during mid-cycle and peak cycles, it has the potential to increase its net profit and cash flow by 5x to 10x, similar to what was seen in 2021 and 2022.

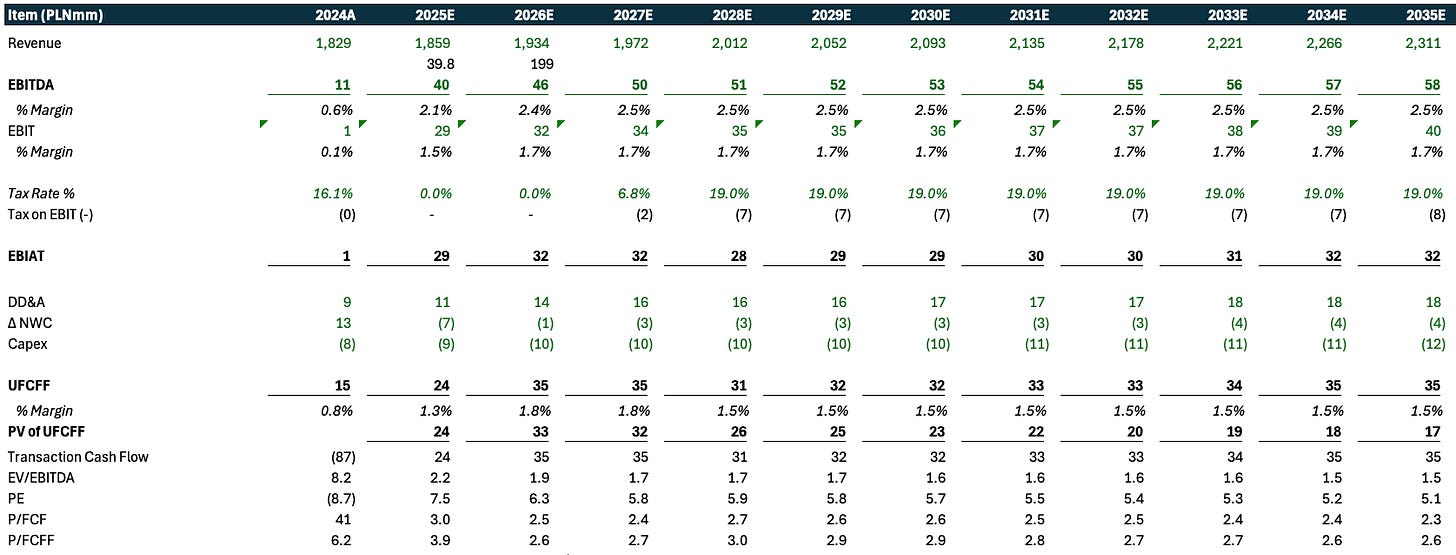

Currently, Bowim is operating below capacity, and production volumes are expected to rise with additional contracts planned for 2025 and 2026. We anticipate continued steady growth, estimating that by 2027 the company will achieve a mid-cycle EBITDA of ~PLN 50mm vs 2024’s PLN 11mm.

Bowim is a net-net, has almost no debt and 63% insider ownership with rather competent management and extensive buyback history (~13% of company was bought back since IPO in 2012).

The company is currently trading at attractive ~2.2x 2025 EV/EBITDA and 1.9x 2026 EV/EBITDA and is expected to turn cash flow positive in Q2 or Q3. At the same time it’s trading at a ~25% discount to NCAV, ~50% discount to Adj. Tangible Book Value (TBV), and 70% discount to Book Value (BV)

We value the company using the target multiple and discounted cash flow (DCF) model. Using a conservative 4x EV/EBITDA multiple on 2027 EBITDA yields an EV estimate of PLN 203mm and a common shareholders' equity value of PLN 208mm. This indicates potential upside of ~134%, with a target price of PLN 10.66/share by the end of 2027 (~50% IRR). Meanwhile our DCF yields ~306% while based on conservative assumptions (no Ukraine peace deal, low/mid cycle pricing). It implies PLN 19.14/share price target at ~3x upside.

Overall we see Bowim as a downbeat stock, that despite being a low-margin business in a highly commoditized industry can benefit immensely from a new steel cycle and a potential Ukraine Peace Deal lottery ticket.

In the worst case scenario (prolonged correction, delayed investments, no peace deal) we think Bowim could reach Its NCAV at 30% and at best well over 300%. This risk/reward makes it an investment case worth playing.

Download Our Model

Business Overview

Bowim S.A. is one of the largest distributors and processors of steel components in Poland, serving the construction, manufacturing, and machinery industries, primarily within the country. Its product offerings include sheet metal (44% of projected 2024 revenue), pipes (19%), rebars (14%), profiles (11%), and prefabricated reinforcements (13%), with other products accounting for 5%. Established in 1995, Bowim has developed into a significant player in its sector and became publicly listed in 2012. Over its 12-year history, the company has experienced two unprofitable years: in 2012 and the previous year.

Approximately 80% of Bowim's revenue comes from the distribution and customization of nearly ready-to-use steel products, while the remaining 20% is generated from its own rebar production. Due to the dramatic increases in energy and material costs since 2020, Bowim's relatively small production segment has had a lower gross margin compared to its distribution and customization. However, as these costs have stabilized since 2023, and It implemented several cost-cutting measures, Bowim is now successfully increasing the profitability of its own production.

Initially, the company began as a steel product distribution business, but after acquiring Beststal in 2007 (rebars, prefabricated reinforcements) and Passat-Stall in 2010 (sheet metal, profiles), It was able to vertically integrate and capture more of the value chain.

After researching Bowim investments and strategic moves over the years, we believe that it is highly opportunistic in its acquisitions and conservative with Capex. This is a good sign of financial discipline in highly volatile and low-margin business like steel products.

Facilities & Distribution Network

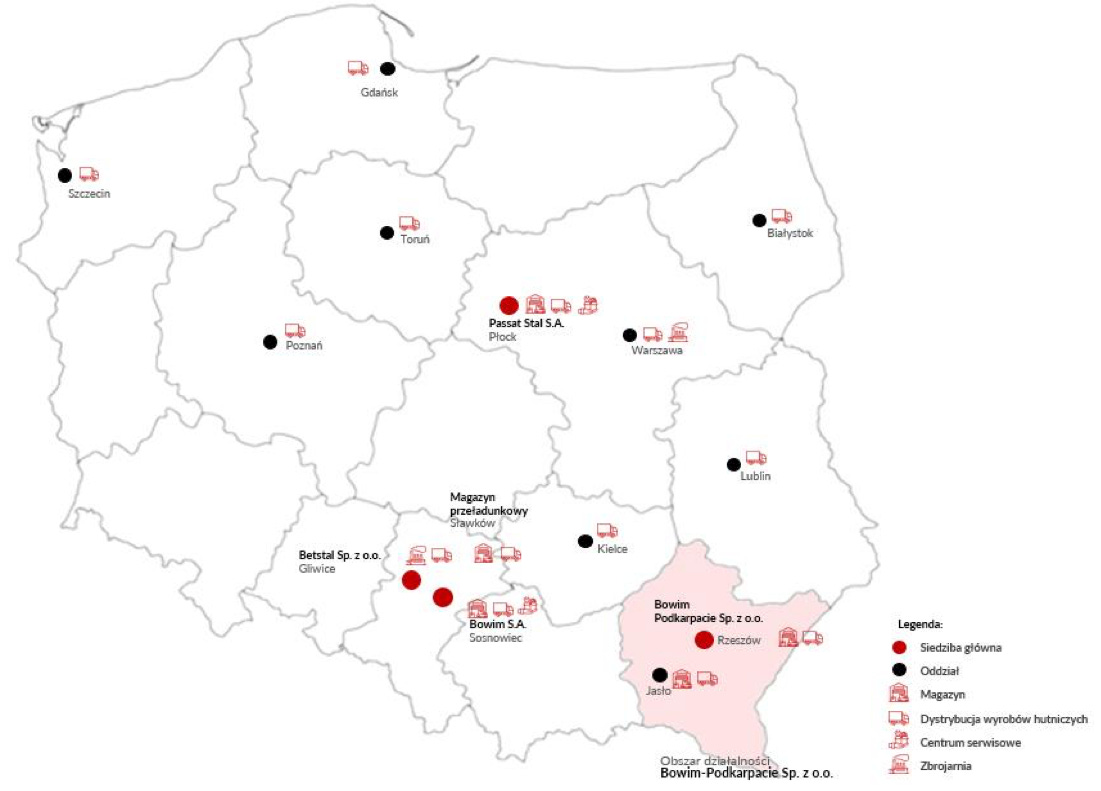

The company has HQ in Sosnowiec and 3 other plants in Gliwice, Rzeszow and Plock. Additionally Bowim operates 9 distribution centers spread across the country to provide the best reach to its customers. Two of these (in Warsaw and Jarlo) have the ability to customize some steel elements like rebars.

End Markets - Major Construction & Infrastructure Exposure

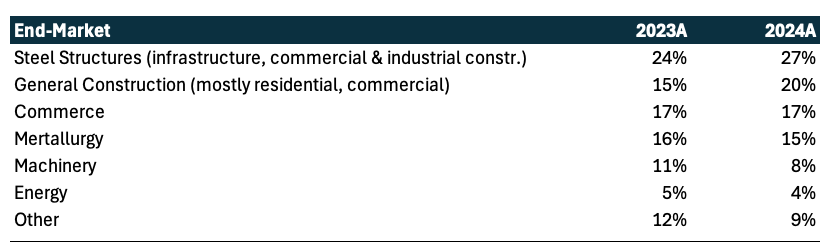

Bowim's end-markets are mostly concentrated in construction and infrastructure, with steel structures representing the largest component at 27% of revenues. These are primarily utilized in large-scale infrastructure, commercial, and industrial construction projects. General construction accounts for 20%, mainly encompassing residential and commercial builds. The Commerce sector, at 17%, involves smaller-scale applications and redistribution, such as sales to construction supply stores. Additionally, Bowim serves the metallurgy industry (15%), largely for automotive and metal product manufacturing. The remaining segments include the machinery industry (8%), energy (4%), and various other sectors (9%).

Steel Market in Poland

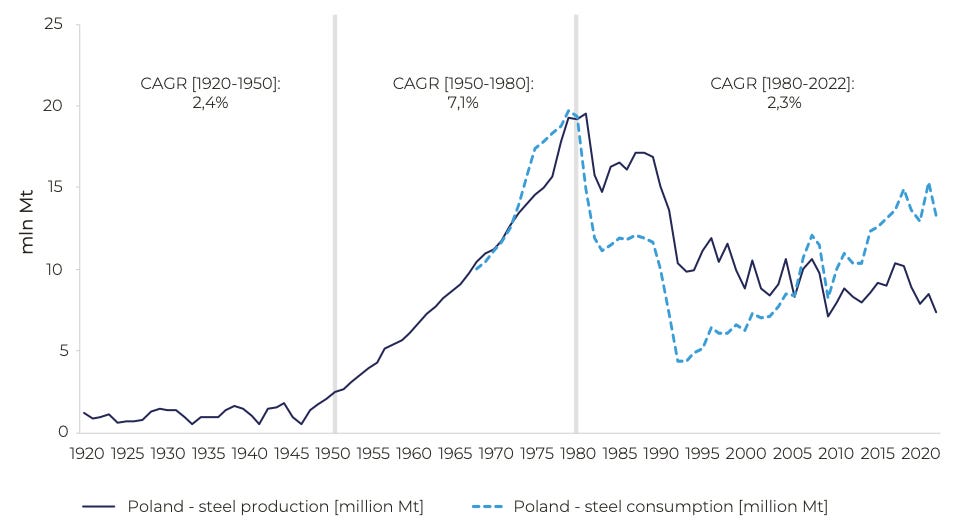

Poland, historically a steel manufacturing powerhouse since the 1950s, maintained self-sufficiency or net exporter status until 2006. Post-2006, with growing energy costs, climate tax a notable reversal occurred, transforming Poland into an increasingly significant importer of steel, increasingly reliant on distribution rather than production.

In 2023, Poland's crude steel production stood at ~6mm tonnes, ranking it as the 23rd largest producer globally. This figure represents a 13% decrease compared to 2022's production of over 7mm tonnes. However, there has been a 2024 volume upturn, with production increasing by 10.1% YoY in 2024 to reach over 7mm tonnes, and a further 3.9% year-on-year increase in January-April 2025, reaching 2.5mm tonnes.

Poland ranks as 18th largest steel consumer taking over 13mm tonnes. To bridge the gap between consumption and production It imported an estimated 6mm tonnes of steel, reflecting this growing reliance on foreign supply and efficient distribution network.

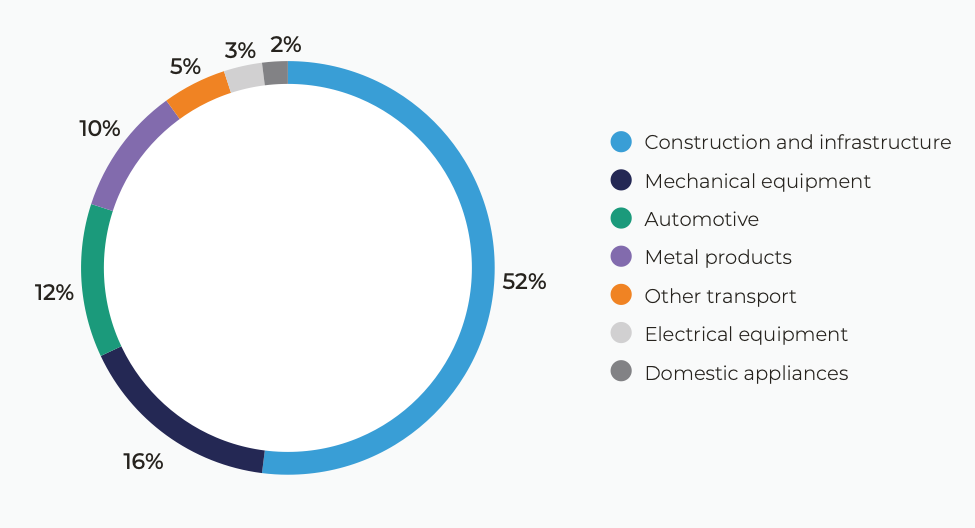

The primary driver of steel consumption within Poland is the construction and infrastructure sector, accounting for a dominant 52% of the total demand. Following construction, the mechanical equipment industry represents the second-largest consumer, utilizing 16%. The automotive industry consumes 12% of the nation's steel supply. Finally, the metal product manufacturing accounts for 5% of the total steel consumption, with its widespread application across many industrial applications.

Residential and Industrial Slowdown …

The Polish construction sector is a significant contributor to the nation's GDP at around 10% in 2022 and at the same time the biggest end-market for Bowim’s steel products. While the It saw robust growth with a 7.7% CAGR between 2020 and 2023, in 2024 experienced a real-terms contraction of roughly 5.7%, putting a stop to extreme period of post-covid growth.

This dip is attributed to elevated interest rates, and a subdued demand. However, according to Poland Construction Industry Databook a strong recovery is anticipated from 2025 onwards, with an average annual growth rate of 3.6% projected until 2028, and a 4.1% CAGR from 2025-2029. This resurgence will be fueled by substantial investments across all segments but especially infrastructure and Industrial construction.

In the last years, residential construction was the biggest driver of growth, but with ~20% YOY reduction in building permits issued in April 2025, it is steadily losing its role. In the meantime Industrial construction (incl. warehousing) although slightly slowed down due to interest rates, still shows some strength, particularly driven by e-commerce sector, with total industrial stock reaching almost 35.3 million sqm in Q1 2025.

However, speculative construction accounted for only 41% of the pipeline, the lowest share since mid-2020. While new commercial leases and expansions declined by 20% year-on-year, lease renewals accounted for a record high of 56% of total take-up, suggesting a preference for retaining existing locations amidst economic uncertainties. However, again declining interest rates could reverse the trend for industrial and residential construction.

… To be Fully Offset by Strong Infrastructure Tailwinds

Poland is initiating an unprecedented wave of infrastructure spending, setting ambitious targets across energy, rail, road, air, and industrial/defense infrastructure. It is estimated that these projects will require almost PLN 2 trillion in investments over the next decade (~56% of its current GDP), and will demand millions of tonnes of raw steel and steel products.

In 2025, the government plans to allocate a record PLN 700 billion (€160 billion) to infrastructure and industry investments, marking the highest amount in the nation's history. This substantial capital injection is complemented by nearly €60 billion from the EU's National Recovery Plan, of which approximately 40% will be spent on infrastructure and government-related construction. This record spending will primarily focus on the defense sector, logistics (warehousing and central hubs), smart cities, and road, rail, and air infrastructure.

However, 2025 is not a one-off year; multiple major projects are currently under construction and are happening simultaneously:

Energy infrastructure (PLN 600bn to be spent from 2023 to 2030, according to EY estimates) - Poland’s energy infrastructure is extremely outdated and still largely reliant on black coal and lignite. This sector requires record investments in combined cycle gas turbine (CCGT) natural gas plants, offshore wind turbines, and nuclear power plants. Additionally, some projects expected to be finalized in the mid-2030s will likely require an additional PLN 500bn in investments.

Electricity transmission upgrades (PLN 65bn, over the next decade) - Similar to power plants, the electricity transmission system is aging and requires expansion to accommodate the needs of new power plants. Investments will focus on modernizing transmission networks, biogas installations, heating systems, and advanced energy storage facilities, reflecting a strategic shift towards a more diversified and secure energy future.

The railway modernization and expansion (PLN 180bn from 2024 to 2032) - This new central airport project will integrate rail and road connections to major neighboring cities and aims to serve up to 34 million passengers annually. The CPK investments also include significant local projects, such as a 4.6-kilometer tunnel in neighboring Łódź to connect the rail station with the airport terminal.

Central Communication Port CPK (PLN 132bn from 2024 till 2032) - It is a new central airport project combined with railway and road integration to major neighboring cities which aims to have a passenger capacity of 34mm people annually. CPK investments also includes major local projects like 4.6 kilometer tunnel in neighboring Lodz to integrate rails station with the airport terminal.

Polish Defense Industry Buildup (PLN 1,900bn to be spent over the next decade, with approximately PLN 800bn likely spent domestically, including on production capacity buildup) - In response to the escalation of the Russo-Ukrainian war, Poland is increasing its defense spending. The defense budget for 2026 is estimated to be around PLN 200bn, which will cover not only the purchase of equipment from abroad and domestically but also the establishment of domestic production capacities and servicing centers for new equipment.

Although it is impossible to predict precisely how these massive projects will translate into steel product consumption, demand could reach new records in the coming years offsetting potential weakness in commercial and residential construction.

Bottoming Prices - New Cycle On The Horizon?

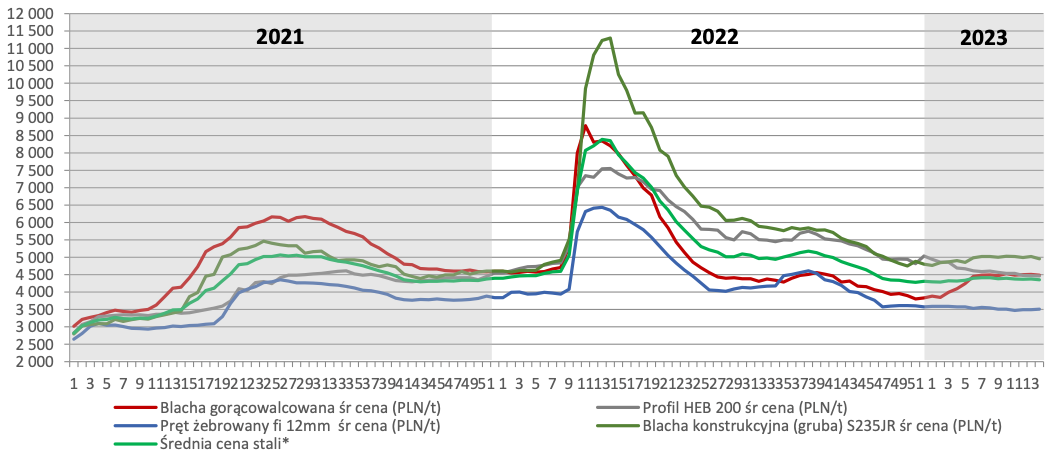

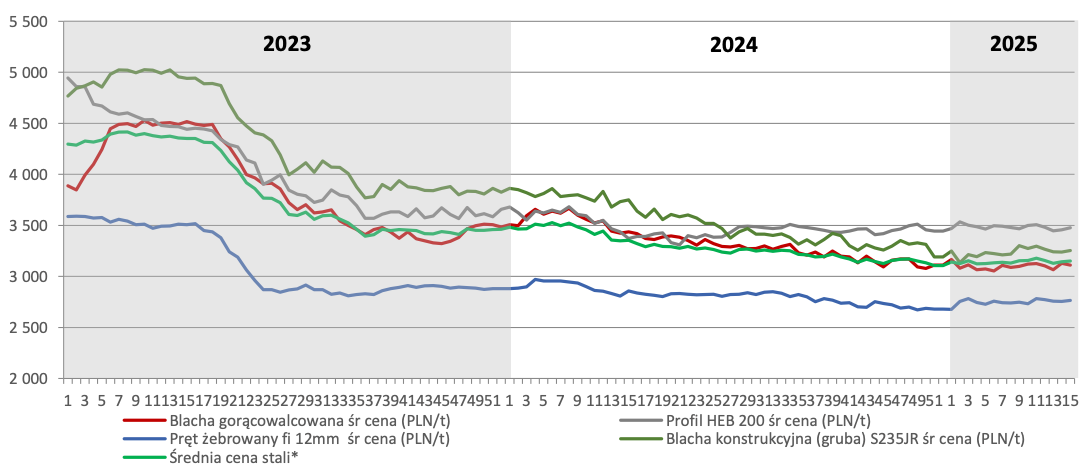

In the last five years, steel product prices have experienced significant volatility. After reaching their lowest point in 2020, prices surged to record highs in 2022 following the outbreak of the Russo-Ukrainian war. During that period, some products increased in price by as much as 500%, with the steel price rising nearly 300%. As 2022 progressed, they began to decrease as local producers diversified and alleviated supply chain strains.

The years 2023 and 2024 marked a period of correction and normalization, with prices returning to trends seen at the end of 2021 and the beginning of 2022. The average steel price dropped from PLN 8,400 to PLN 3,150, (63% decrease). Interestingly, despite the decline in demand and prices, Bowim managed to grow its sales volume by 7% in 2024, successfully gaining an edge over its competition, which is a positive sign of its position.

So, if steel products are declining, why consider buying a low-margin steel product distributor and manufacturer? Well, they are no longer in decline. Price data for 2024 and 2025 indicate that we have reached a local bottom at the end of 2024. The average steel price has already increased from PLN 3,100 to PLN 3,200 and some products appreciated up to 10%. While this alone is not a definitive indicator of a new cycle, huge infrastructure spending and declining interest rates lead us to believe that we are on the verge of one.

What can happen this cycle?

It’s impossible to predict where the steel product prices will go and when the peak may occur. However, considering the increasing spending on infrastructure projects and Poland's growing dependence on imports, we believe it's possible to reach at least 90% of the 2022 prices within two years, compared to over 60% currently. If a peace deal in Ukraine is signed, we might even see prices rise to 110%, potentially breaking new records.

What it would translate to? At these record prices Bowim generated almost PLN 120mm in Free Cash Flow and over PLN150mm EBITDA in 2022 and appreciated to ~PLN 15/share achieving ~1,200% since 2020’s bottom and ~500% since the end of 2020.

At 80% of 2022 average prices, we are talking about 33% appreciation from the current product prices which would result in ~PLN45mm in FCF and ~PLN61mm EBITDA. This seems realistic and to give you a point reference, this company’s market cap is just PLN 81mm and EV PLN 87mm… that’s what we call cheap

Extremely High Insider Ownership & History of Buybacks

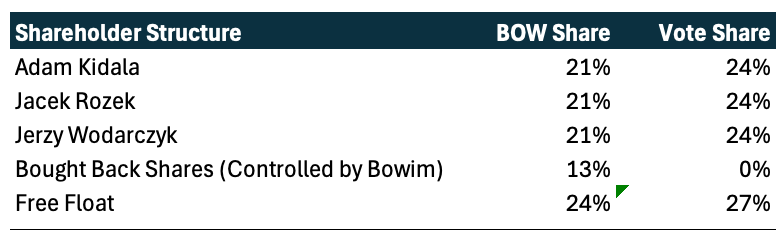

Bowim has very high insider ownership standing at 63%. It is composed of three main management members - Adam Kidala (21%), Jacek Rozek (21%), and Jerzy Wodarczyk (21%). This effectively aligns the management closely with other shareholders and is a big plus.

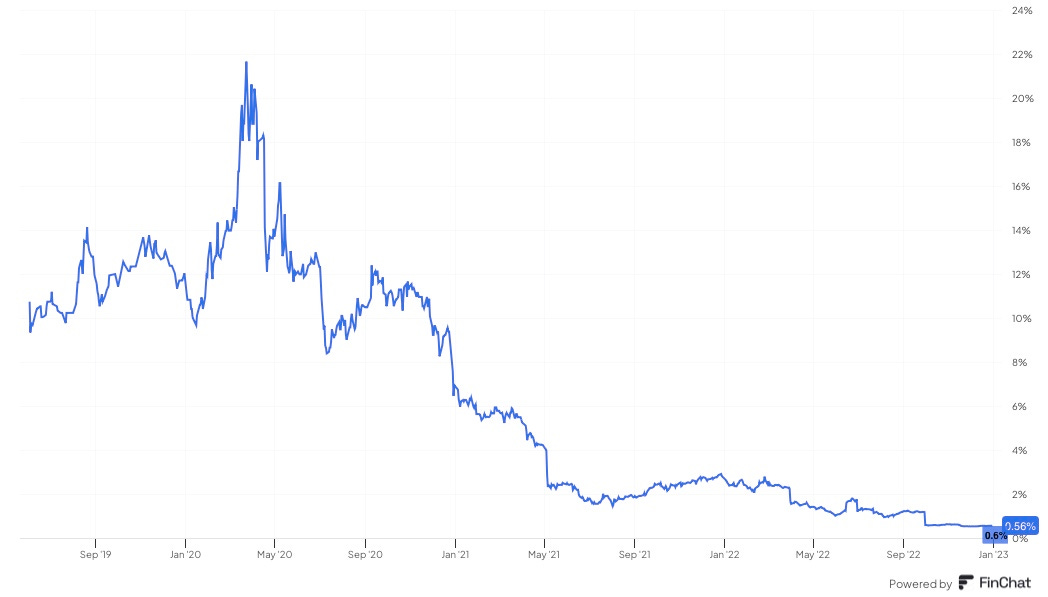

The company has 13% of stock in its treasury - the result of over a decade of buybacks halted last year due to worsening profitability. For a long time the company was having buyback yield of above 10%. With improving market conditions we could see the buybacks spike again adding to the upside.

We believe the management is rather competent, with two-three decades of management and industry expertise. They successfully navigated their low-margin, commoditized business, engaging in opportunistic M&A like acquisition of Passat-Stal in and Betstal (proved accretive deals). Effectively, they vertically integrated their business and lowered cost base. Additionally, management keeps assets fairly modernized with stable Capex spread across many years.

Margin of Safety

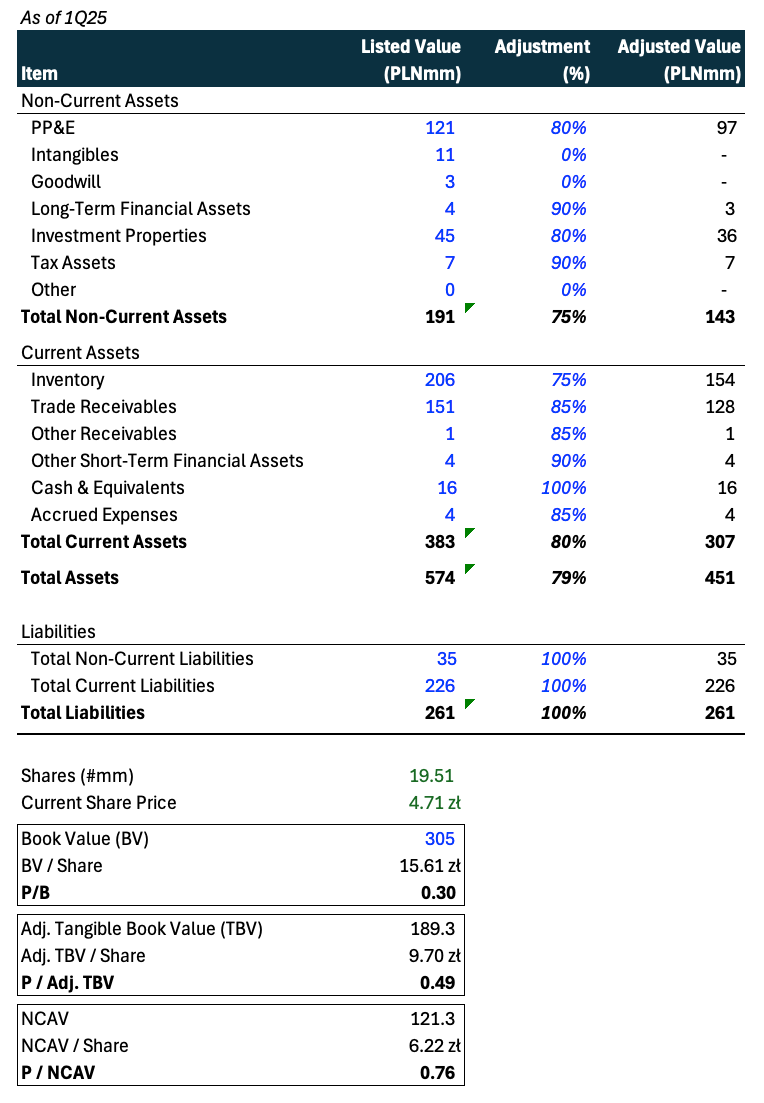

Bowim is clearly not a monopoly, nor is it a business that is nearly impossible to replicate. It operates with low margins, primarily depending on distribution and, to a lesser extent, its own production. At first glance, this may seem like a risky investment. However, what provides a margin of safety is its extremely low price. Bowim is one of the cheapest businesses we've seen, with very low multiples and a net-net status (current assets - total liabilities > market cap).

It currently trades at a price-to-earnings (P/E) ratio of 7.5x for 2025E and 6.3x for 2026E. The Enterprise Value to EBITDA (EV/EBITDA) ratio stands at 2.2x for 2025E and 1.9x for 2026E. Additionally, Bowim has a price-to-free cash flow (P/FCF) of 3.0x for 2025E and 2.6x for 2026E.

The company has almost no debt and holds PLN 5mm in net cash. Bowim trades at a Price-to-Book (P/B) ratio of 0.30x and after applying conservative adjustments, we believe it trades at approximately 0.49x P/Adjusted Tangible Book Value (TBV).

Most importantly, Bowim is classified as a net-net, trading at 24% discount to its Net Current Asset Value (NCAV), calculated as Current Assets minus Total Liabilities. It essentially means that if company would be taken off the exchange and liquidated, even without fixed assets like its plants Bowim would still provide ~32% upside.

DCF Valuation

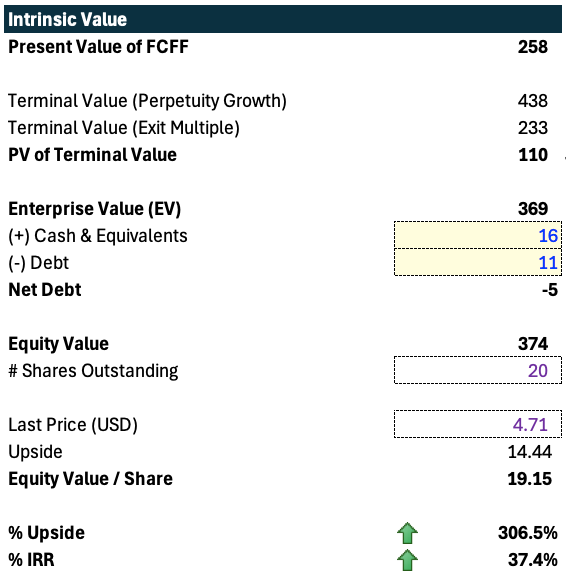

DCF is not our preferred valuation, the simple multiple is, but we think it can also shed some light on the company’s prospects. For the exit multiple, we assumed a 4x EV/EBITDA, which is below the industry average of 5x. We used a discount rate of 8.6% for the weighted average cost of capital (WACC), derived from the capital structure and current Polish interest rates.

Using a conservative mid-cycle cash flow forecast, we estimated the Enterprise Value (EV) to be approximately PLN 369mm. After adding about PLN 5mm of net cash (total debt after asset sale minus cash) and dividing the Equity Value by the number of shares outstanding, we determined a target price of PLN 19.15 per share. The current share price of PLN 4.71 implies an upside potential of ~300%…

Multiples Valuation

Our preferred way to value the business is through good old multiple slap. In case of cyclicals like Bowim the best results are yielded by the mid cycle EBITDA, which we conservatively estimate based on ~65% 2022 peak product prices. This would generate Bowim ~PLN 50mm EBITDA.

With almost zero debt and a conservative multiple of 4x (below industry’s 5x) we can estimate EV of PLN 203mm and equity value of PLN 208mm implying a share price of PLN 10.66 and implying 134% upside by the end of 2027 (~50% IRR).

Please note that this doesn't include the additional EBITDA spike that can come from peak pricing or extra demand from Ukraine rebuilding efforts. It is likely that Bowim could reach $70mm EBITDA in 2027, if peace is signed and therefore have a 2.1x upside just based on multiples.

Key Risks:

Delayed infrastructure investments

Delayed or slow residential construction recovery

stickier inflation combined slower interest rate cuts

Prolonged war in Ukraine

This is a fairly simple business which despite being a low-margin and cyclical, can benefit from high operating leverage and potentially gain lots from a possible Ukraine peace deal. What provides a great margin of safety is Bowim’s low multiples and NCAV higher than the market cap. We will be adding Bowim to our portfolio as one of our minor positions.

We had to simplify many things and if we made any mistakes, we are sorry and encourage you to correct us :) If you enjoyed this publication please like, and comment! It would mean a great deal to us and help grow our research blog :)

We would love to post our analysis more often but recently there has been a lot happening in our professional careers and personal life. If you like what we do and want to support us in making this blog our primary source of income consider upgrading your subscription. We appreciate your help!

Disclaimer

The information contained on this website is not and should not be construed as investment advice and does not purport to be and does not express any opinion as to the price at which the securities of any company may trade at any time. The information and opinions provided herein should not be taken as specific advice on the merits of any investment decision. Investors should make their own decisions regarding the prospects of any company discussed herein based on such investors’ own review of publicly available information and should not rely on the information contained herein.

The information contained on this website has been prepared based on publicly available information and proprietary research. The author does not guarantee the accuracy or completeness of the information provided in this document. All statements and expressions herein are the sole opinion of the author and are subject to change without notice.

Any projections, market outlooks or estimates herein are forward looking statements and are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur. Other events that were not taken into account may occur and may significantly affect the returns or performance of the securities discussed herein. Except where otherwise indicated, the information provided herein is based on matters as they exist as of the date of preparation and not as of any future date, and the author undertakes no obligation to correct, update or revise the information in this document or to otherwise provide any additional materials.

The author, the author’s affiliates, and clients of the author’s affiliates may currently have long or short positions in the securities of certain of the companies mentioned herein, or may have such a position in the future (and therefore may profit from fluctuations in the trading price of the securities). to the extent such persons do have such positions, there is no guarantee that such persons will maintain such positions.

Neither the author nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein. In addition, nothing presented herein shall constitute an offer to sell or the solicitation of any offer to buy any security.

External links, if any, may redirect you to a privately-owned web page or site (“site”) created, operated, and maintained by a third party, which may not be affiliated with Alpha Ark. The views and opinions expressed on the site, other than those presented by Alpha Ark, are solely those of the author of the site and should not be attributed to Alpha Ark. We have not verified the information and opinions found on the site, nor do we make any representations as to its accuracy and completeness as to the third-party information. Further, Alpha Ark does not endorse any of the third-party’s products and services or its privacy and security policies, which may differ from ours. We recommend that you review the third-party’s policies, terms, and conditions to fully understand what information may be collected and maintained as a result of your visit to this website.

Great! Thanks for the article

Good job guys, stock seems cheap and I like that in your scenario you decided to take pretty conservative assumptions. However such a huge upside seems extraordinary even with those risks in mind. I'm also super happy that you decided to explore polish market, since in overall it seems undervalued compared to western markets