Rockhopper (RKH.L) - O&G Growth Story for 17 Cents on a Dollar

Under-the-Radar Offshore Development in the Heart of Falkland Basin

Summary

At first look, Rockhopper Exploration is a shell of the company, with almost no revenues and no cash flows. However, when we look deeper, we see that It is sitting on the fourth largest pre-FID deepwater oil discovery worldwide worth over $2.3bn (NAV) for just $0.4bn EV company.

Rockhopper Explorations is set to become one of the most profitable O&G companies in the world (by margin) with ~$25/bbl total cost ($17/bbl Opex and $8/bbl maintenance Capex). The current Brent price of ~$75/bbl would yield a 67% gross margin allowing for a significant margin of safety in the highly volatile industry, which could make it trade at a premium.

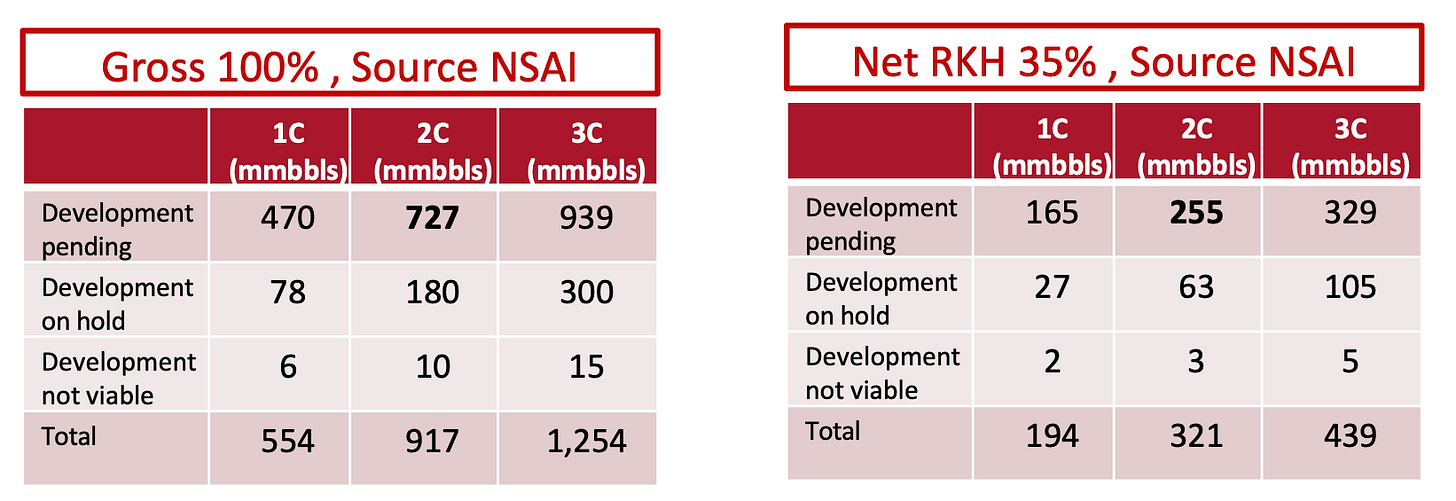

The company has 321 mmbbls in 2C resources from its main project — Sea Lion (35% working interest with the remaining 65% owned by the partnering Navitas).

There is potential for discovering additional oil in the nearby fields that have not yet been fully surveyed. Insights from management and a history of upward 2C estimate revisions, (77% increase in the 2C resources estimate), suggest that the amount of oil in the ground may be significantly underestimated.

It will be one of the cheapest O&G developments worldwide set to be drilled at a 0% interest rate in the first and most expensive single phase of the investment.

Rockhopper is in the pre-final investment decision phase (pre-FID), with the final commitment expected in 2H 2025 (September deadline) and the first production in 2H 2027.

During the 1st development phase, Rockhopper expects peak and average production of 55kbbls/day and 35kbbls/day, respectively. As next phases are competed avg. production is projected to grow 4 fold.

The Joint Venture of Navitas and Rockhopper is expected to spend $1.50-1.75bn on the 1st investment phase and $2.25-2.50bn on phases 2 and 3. Rockhopper and Navitas will provide 35% and 65% capital respectively.However, in the first phase, RKH will spend only ~$70mm with the rest of the 1 being funded by Navitas at 0% interest loan to the partner. The outstanding amount will be gradually paid back to Navitas to reach 35% interest as production starts.

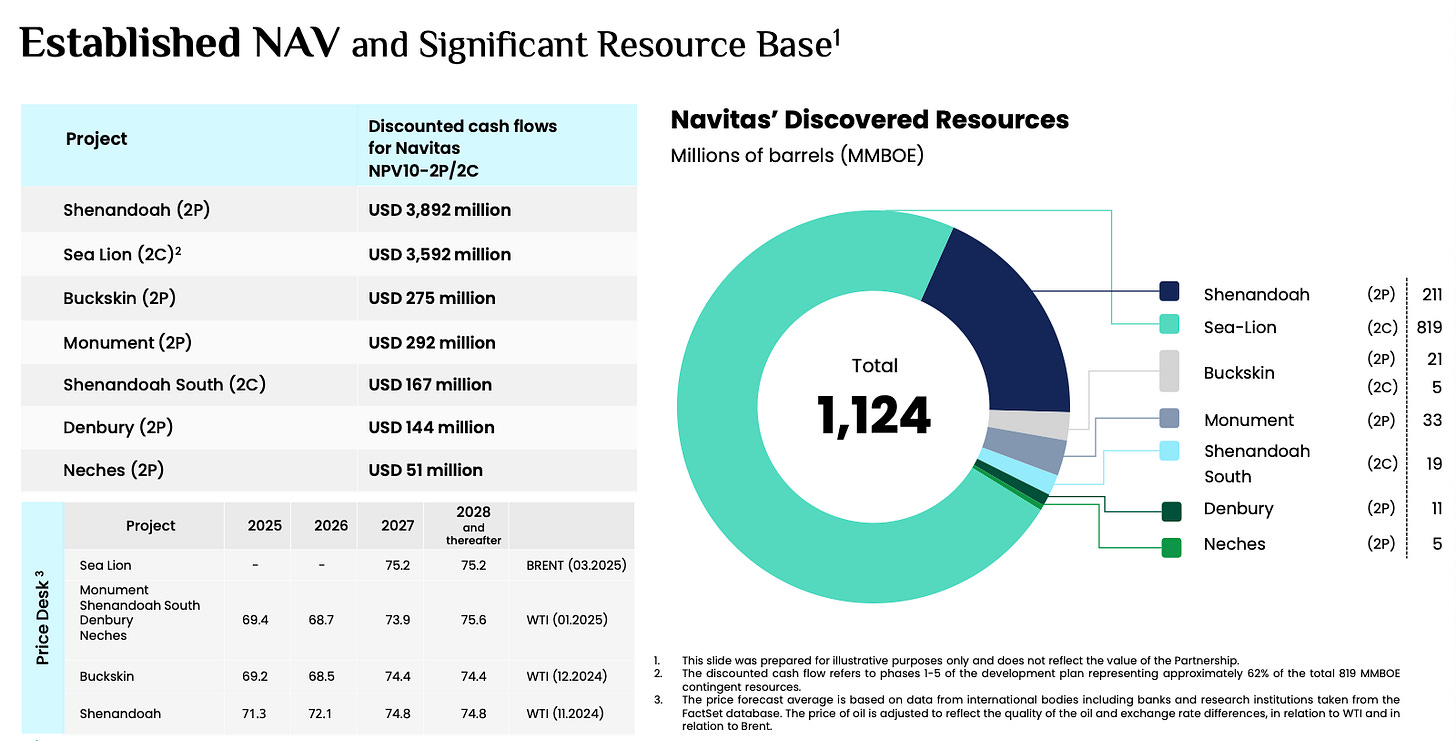

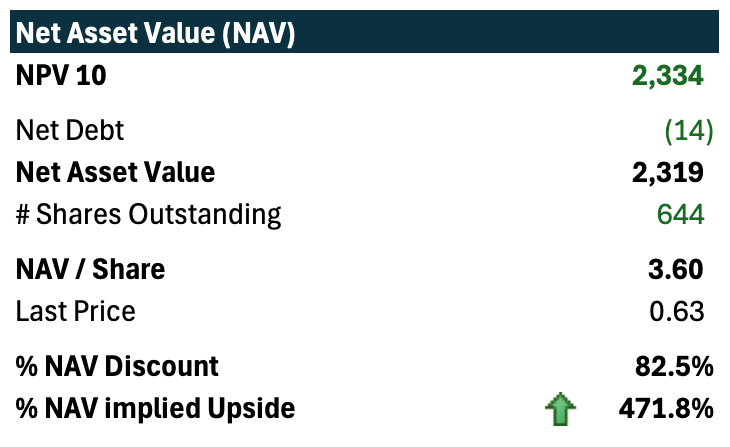

We value the company using the Net Asset Value (NAV) and discounted cash flow (DCF) model. A steep 10% discount rate at $70/bbl crude and 77% conversion of 2C resources to 2P reserves, yields a NAV of $2.3bn on the current $0.4bn EV meaning Rockhopper trades at 17 cents on a dollar (~83% discount to NAV) with a potential 5x upside.

Our life of the asset DCF is based on adjusted Navitas estimates, est. 8% WACC, and $70/bbl crude oil price, implies a $4.58/share price target at ~6x upside.

The only thing we don’t like about the company is 2 years of waiting till we see a major Free Cash Flow uplift but in the case of Rockhopper we will turn a blind eye due to the following:

The company is profitable despite almost no core assets developed and has nearly zero debt.

The near-term catalyst of the Final Investment Decision (FID) is expected in 2H 2025 most likely by the end of September 2025 (current deadline).

Unlike startup, it is not exposed to rapidly changing technology, regulatory environment, and demand.

The financial situation is sound, the company has almost no debt, an experienced partner and free financing (0% thanks to Navitas).

There’s a huge value gap yet to be bridged providing sb — Rockhopper is sitting on $2.3bn of NAV while trading at $0.4bn EV resulting in 83% discount based on which there’s nearly 5x upside potential within 4-5 years when the market realizes the growth in RKH’s FCF.

There’s a high chance for further upward appraisals and more oil to be found in several other fields in the area.

Download Our Model

Before we begin, I would like to thank EpsilonTal for inspiring this deep dive. Through his work, we discovered an incredible opportunity in the Falkland Offshore. He is a talented and insightful creator who has been sharing his views on offshore and Israeli companies for some time, mostly on X. Give him a follow! It’s worth it.

Business Overview

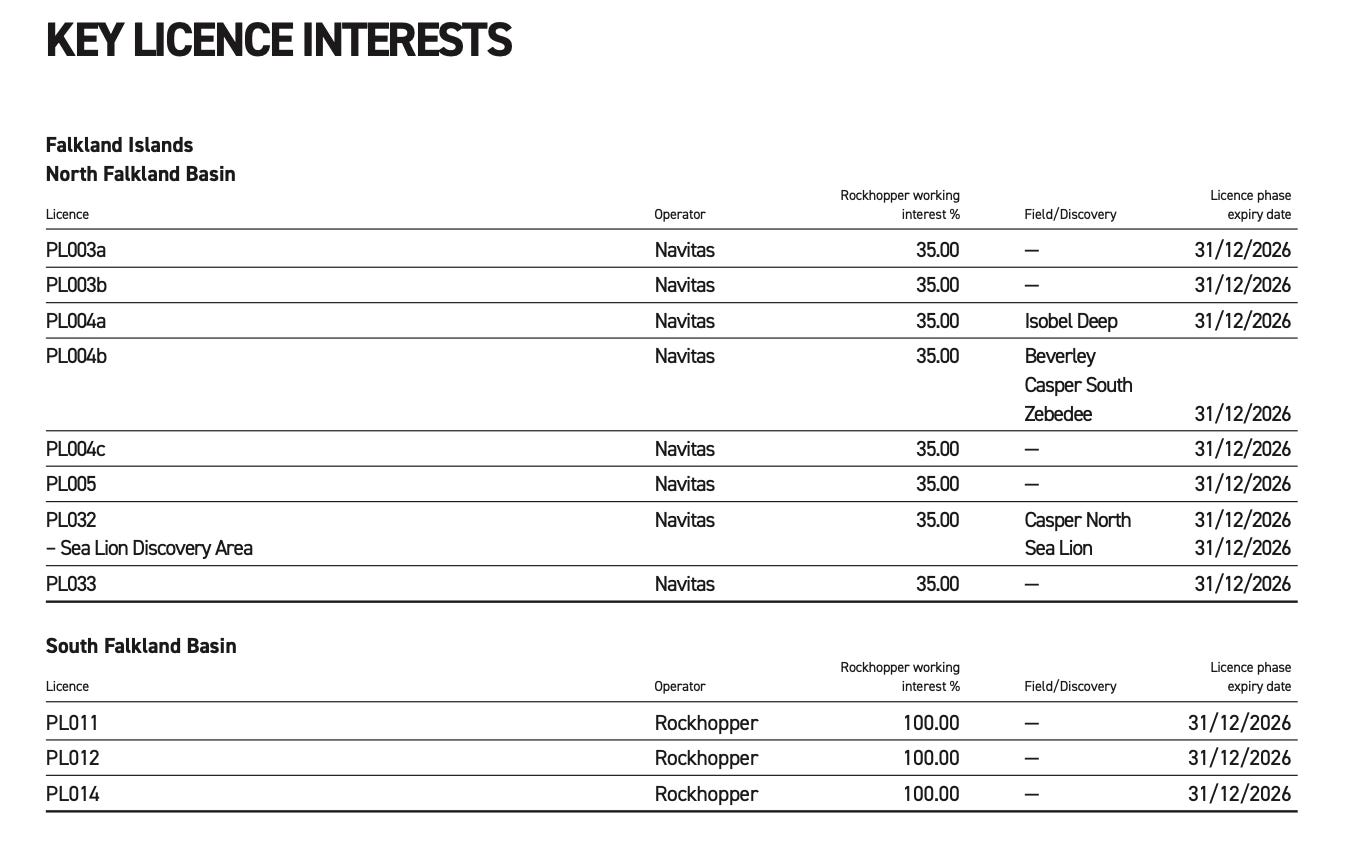

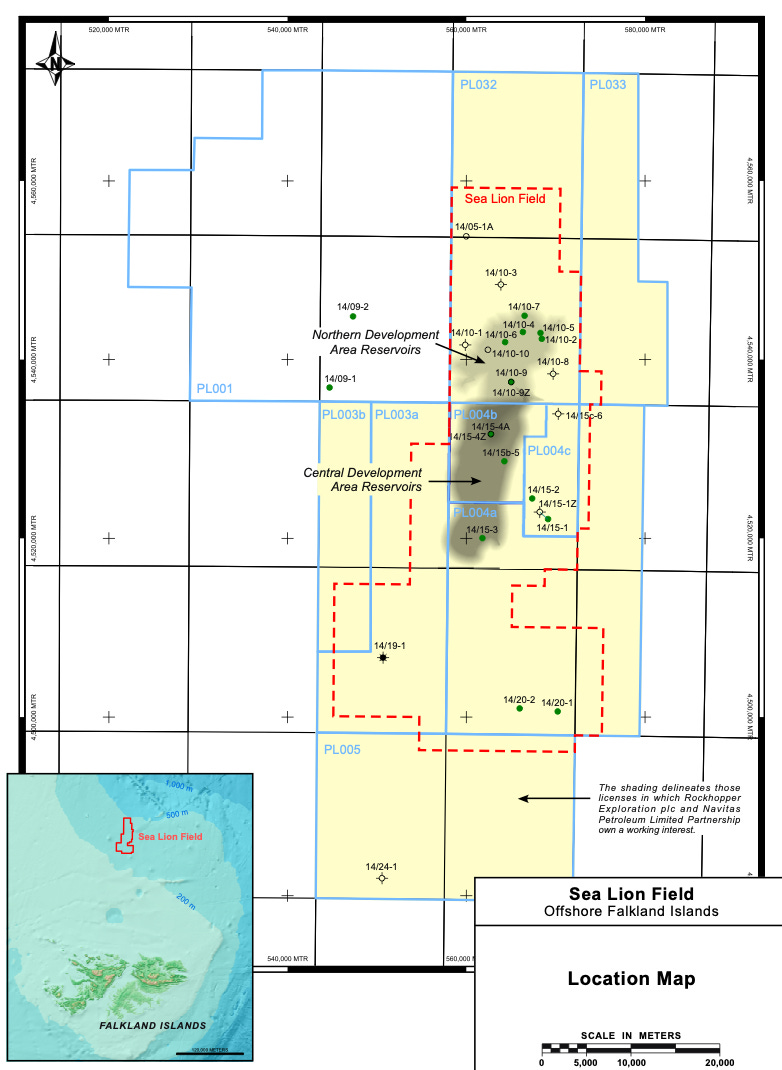

Rockhopper Exploration (RKH) is a UK-based exploration and production (E&P) company with licenses in the Falkland Basin. Notably, Rockhopper holds a 35% working interest in the Sea Lion project and its associated licenses in the area. Additionally, the company operates several other fields in the South Falkland Basin and, until a few years ago, owned various assets in Italy.

The company’s current interest in Sea Lion is estimated at 321 million barrels (2C). As other fields have not yet been fully surveyed, the actual number could be significantly higher.

Now let’s take a closer look at what Rockhopper’s treasure — it’s oil field portfolio.

Closer Look at the Assets — Penguin Sea full of Oil

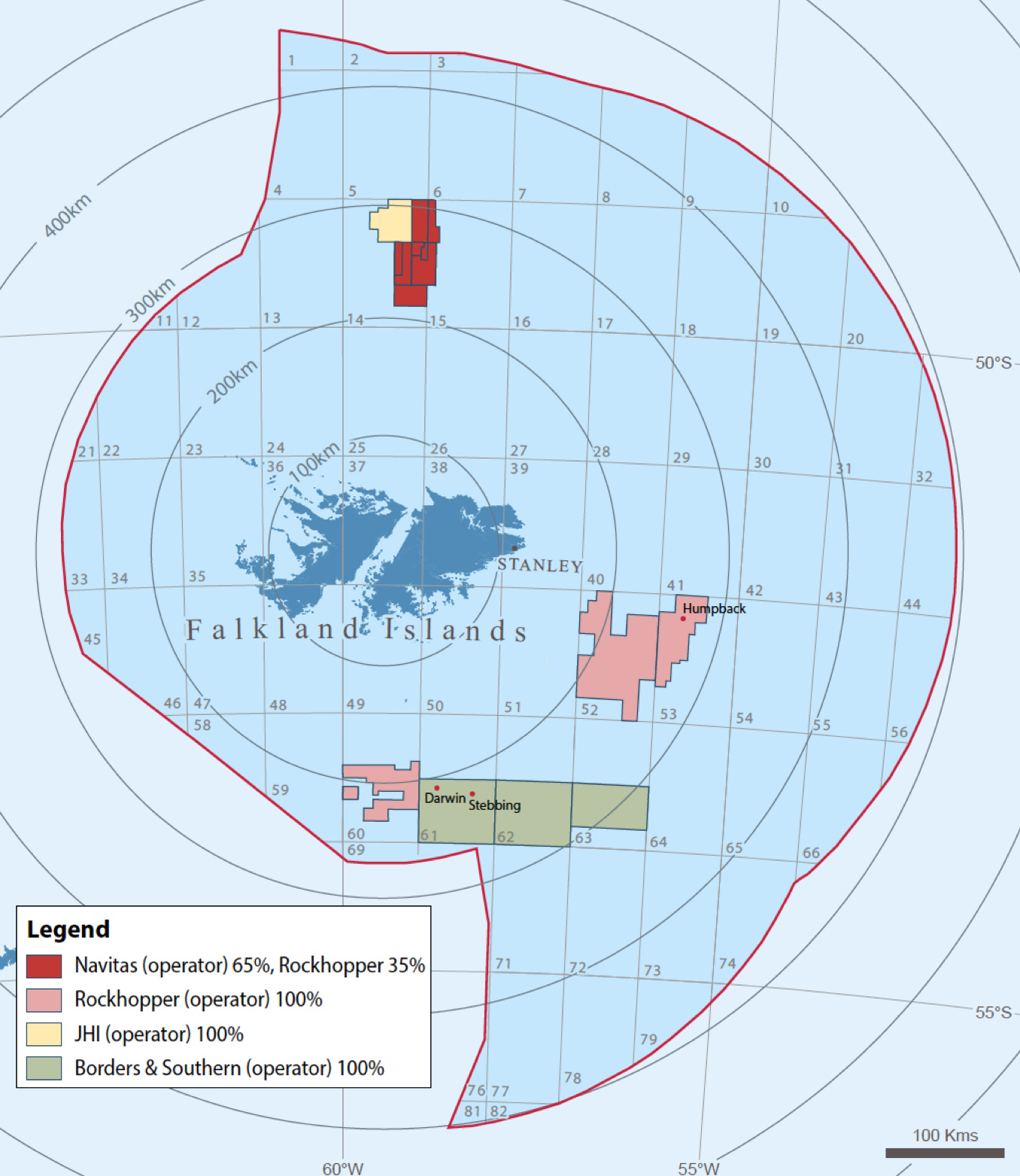

Most of Rockhopper's assets are situated in the North and South Falkland Basins. This distant and frigid region, with 3.5k population, 6°C (43°F) average temperature and 1mn penguins was for long thought to be bare… until 2010, when Rockhopper hit the jackpot.

Falklands Fields Map:

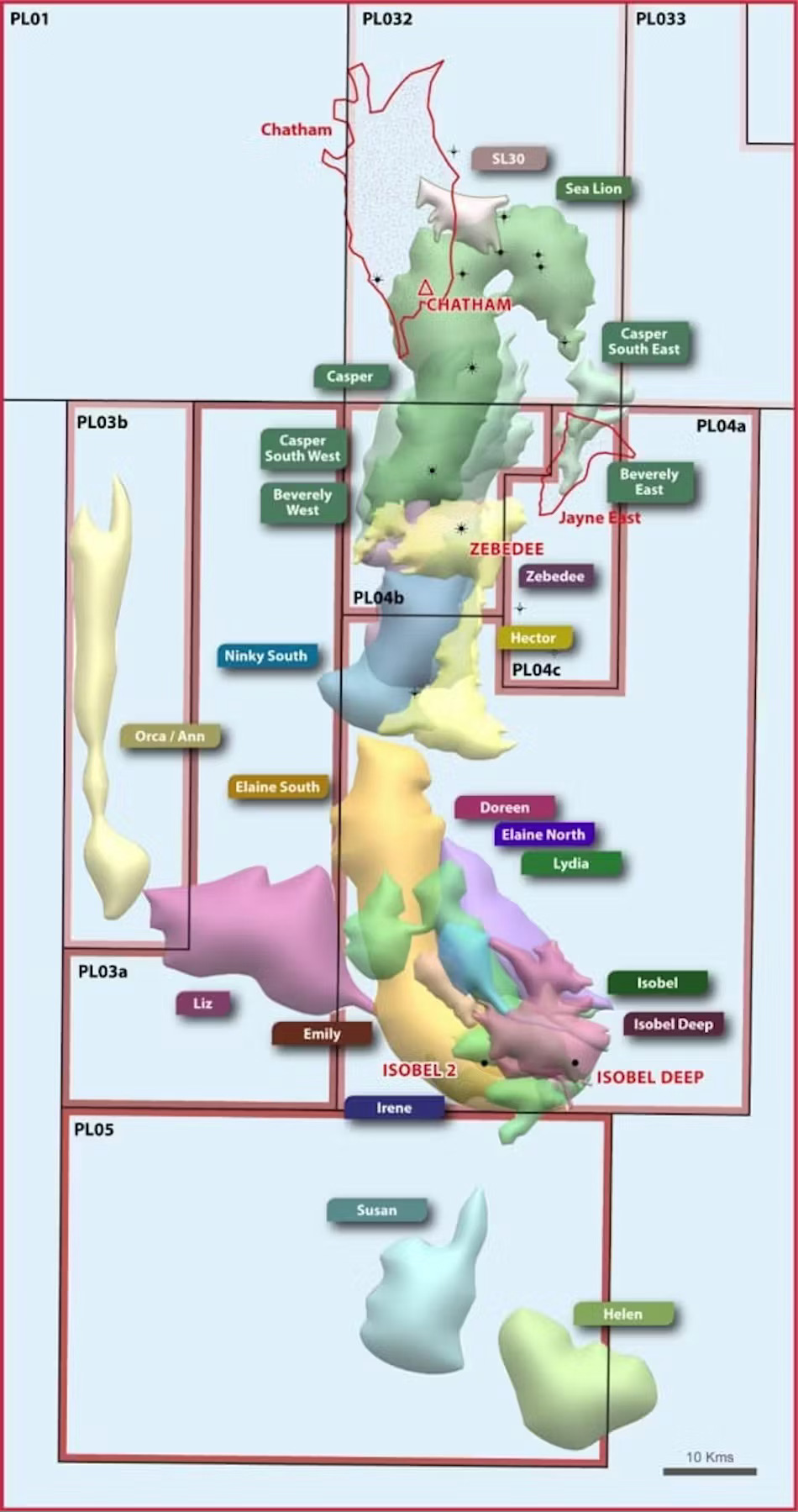

North Falkland Basin (NFB) aka Sea Lion

History:

The initial exploration in this area began in 1982. Although some oil was discovered, no commercial volumes were proven at that time. In 2010, Rockhopper started operating in the area and made a significant discovery of by utilizing 3D seismic data.

Following several flow tests and appraisals, relatively young and small Rockhopper looked for partners to develop this increasingly promising project. In 2012, it entered into a partnership with Premier Oil, offering them a 60% working interest. Together, they conducted additional tests and a drilling campaign in 2015-2016.

Rockhopper grew optimistic about the prospects, but faced several delays, as Premier Oil was heavily invested in other projects at the time.

In 2021, Premier Oil merged with Chrysler, which streamlined their portfolio and effectively created Harbour Energy. Shortly after, the new entity announced its decision to exit the Sea Lion project to focus on "infrastructure-led, lower-risk opportunities in areas with an existing Harbour producing presence,” primarily in the North Sea. Additionally, Harbour Energy aimed to improve its balance sheet instead of spending over a billion dollars on initial production infrastructure.

Starting in 2021, Rockhopper began collaborating with Navitas, which agreed to finance almost all the capital required for the initial phase of development in exchange for a 65% working interest.

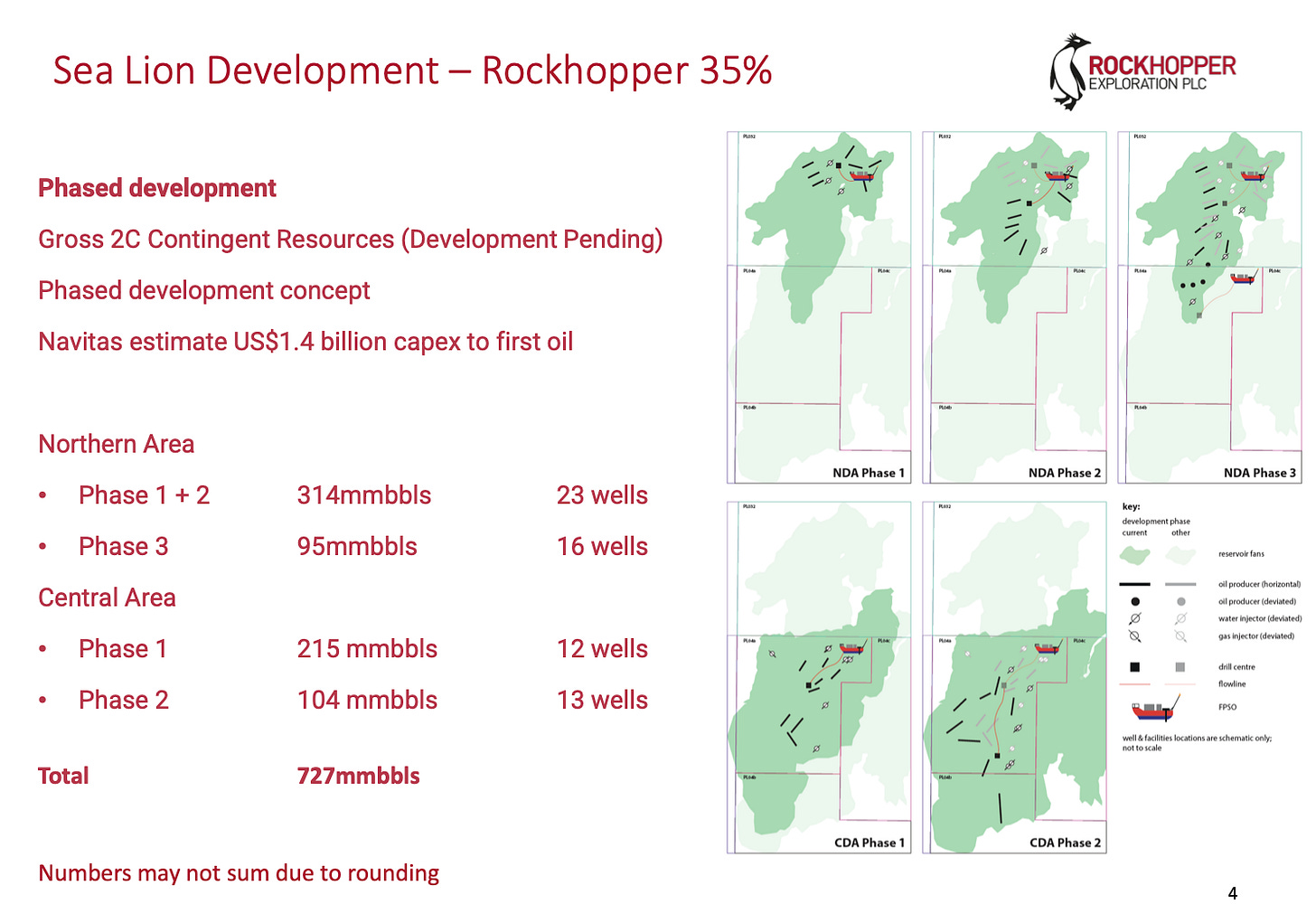

Resources / Reserves: According to the latest NSAI study, this is the largest field discovered in the region with 2C resources estimated at 917 million barrels (mmbbls), of which 321 mmbbls are attributable to Rockhopper (RKH). Out of these, 727 mmbbls (255 mmbbls attributable to Rockhopper) are pending development.

Resource Estimates Keep on Growing

Estimates for the Sea Lion 2C resources have been revised upwards twice as appraisers gained a better understanding of the Rochopper’s fields. In the reports released in October 2024 and December 2024, the 2C estimates increased by 16%, rising from 791 mmbbls to 917 mmbbls, compared to the previous report in January 2024.

For context, the last independent report from 2016 indicated a 2C estimate of 517 mmbbls. The current estimates represent a 77% increase in resource size compared to the initial estimate.

During the conference call in March, Gideon Tadmor, CEO of Navitas Petroleum, commented on the significant increase in estimated resources for Sea Lion, which effectively doubled the net asset value (NAV) of the project. He noted that this increase occurred without a major ongoing exploration. Given this, it is possible that Sea Lion and other Falkland fields may provide even more oil than currently anticipated, especially following two major appraisals.

Development Plan: The Sea Lion project will be executed in phases, starting with the northern and central parts of Sea Lion, followed by the southern area:

Phase 1: 23 wells, including 6 pre-drilled ones. Of these, 11 wells will be in the North Area and 12 in the Central Area. The total expected recovery from this phase is approximately 382 mmbbls, with Rockhopper's share estimated at 134 mmbbls.

Phase 2: 25 wells, with 12 located in the Northern Area and 13 in the Central Area. The anticipated extraction from Phase 2 is 251 mmbbls, of which Rockhopper is expected to receive 88 mmbbls.

Phase 3: 16 additional wells will be drilled, with an expected production of 95 mmbbls.

Production & Timeline: Initial oil production is targeted to start by the end of 2027, while Phase 1 is expected to be completed by around 2029-2030. Phase 2 will most likelybe completed by mid-2035. The peak production rate forecasted after the completion of Phases 1 and 2 is ~50,000 barrels per day (kbbl/day), with an average expected production rate of ~33 kbbls/day. As more wells are drilled in Phase 3 and beyond, production is projected to increase by 3-4 times, reaching a peak of 200 kbbls/day.

Logistical Problems: According to Riviera, Sea Lion and other Falkland developments, while being highly profitable, may still face significant logistical challenges: “Sea Lion is one of the most remote oil projects ever contemplated as it is in the North Falkland basin, thousands of nautical miles from major offshore logistics bases. Port Stanley in the Falkland Islands is expected to be a main local supply base for this project and its ongoing maintenance.”

Capital Expenditure: The total estimated capital expenditure for all phases should be close to $4bn, with the initial $1.4bn to first oil. Total phase 1 will most likely cost $1.7-1.8bn

Additional information about Phases 1 and 2 of the Sea Lion Project can be found in a detailed report by NFAI — the agency assessing the Sea Lion field. Keep In mind that our numbers will be different compared to NFAI’s because we will model all planned phases (including 3+ phase), use slightly lower oil price of $70 per barrel and employ a more realistic cash flow methodology (please see valuation section for more details).

South Falklands

Rockhopper holds three oil licenses in the South Falklands with a 100% working interest. Currently, details regarding specific resource estimates and development plans for these licenses are not available, as they have not been fully surveyed and no significant oil discoveries have been made. Given that this exploration is at an earlier stage compared to the Sea Lion project, there is potential for some of these fields to contain meaningful resources, which could provide additional advantages for Rockhopper.

Italy (Divested / Phased-out)

Rockhopper used to have working interests in three Italian projects:

Ombrina Mare: This was the company's primary asset located in the shallow waters of the central Adriatic Sea, off the coast of Abruzzo. Rockhopper acquired this license in 2014 and obtained environmental impact approvals.

AC19: This project is situated in the northern Adriatic and contains two discovered gas fields, along with an additional adjacent prospect.

Monte Grosso: Located in Southern Italy, this onshore project is considered Europe’s largest undrilled oil prospect. It lies on trend with producing fields such as Val d'Agri and Tempa Rossa.

History: In 2015, Italy reintroduced a general ban on new oil and gas drilling projects within 12 miles of its coastline. This effectively hindered Rockhopper from developing its primary asset, Ombrina Mare, despite previous approvals and investments. The combination of growing regulatory uncertainty and public protests made it increasingly challenging to develop these assets. Consequently, Rockhopper decided to exit Italy and seek compensation for the damages incurred.

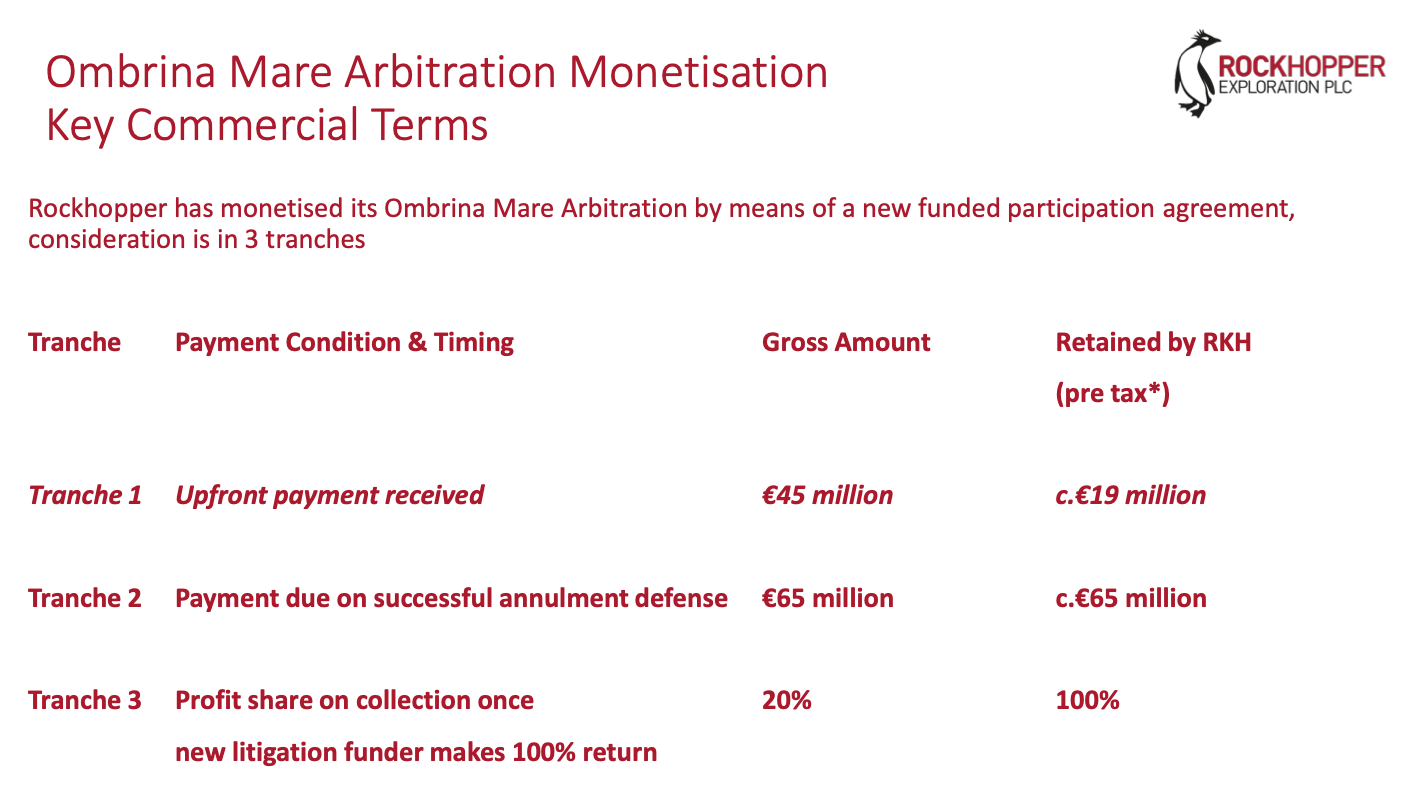

Pending Compensation: In August 2022, an ICSID (International Centre for Settlement of Investment Disputes) arbitration panel unanimously ruled in favor of Rockhopper, awarding the company €190 million plus interest (at EURIBOR + 4%, compounded annually from the beginning of 2016). However, this ruling was annulled in October 2022 due to a failure by one of the arbitrators, Charles Poncet, to disclose a quashed criminal conviction from over 25 years ago in the Milan courts.

Since then, Rockhopper has monetized its arbitration by entering into an agreement with a specialist fund to advocate on its behalf. As a result, the company received an initial payment of €19mm, expecting up to €65mm upon successful defense of the compensation claim. To safeguard itself against potential future setbacks, the company also obtained an insurance policy that guarantees a minimum payout of €31mm.

Unfortunately, just two weeks ago, Rockhopper reported an unsuccessful defense, meaning it will only receive the €31mm from the insurance instead of the possible €65mm.

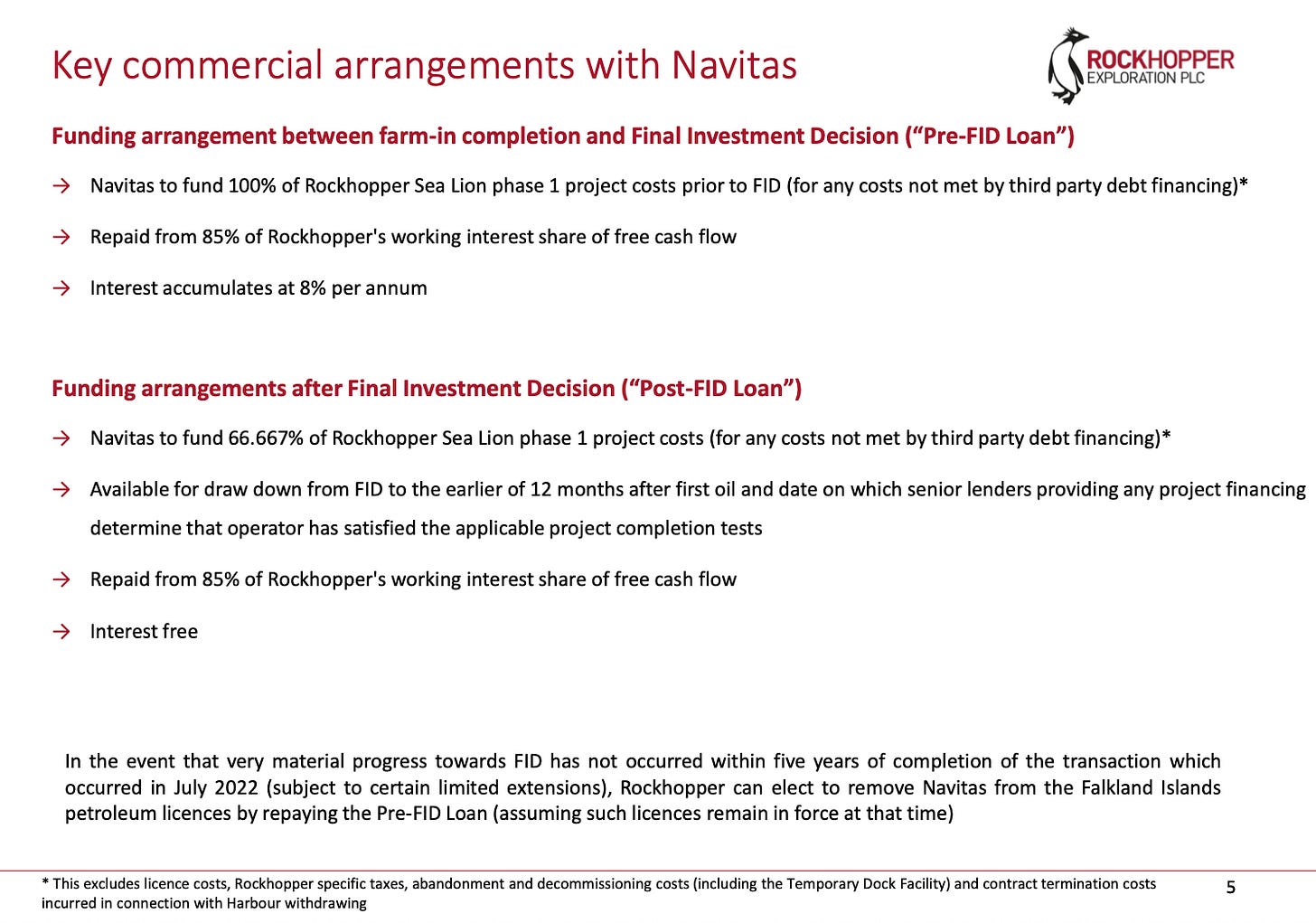

Navitas — A Key Partner

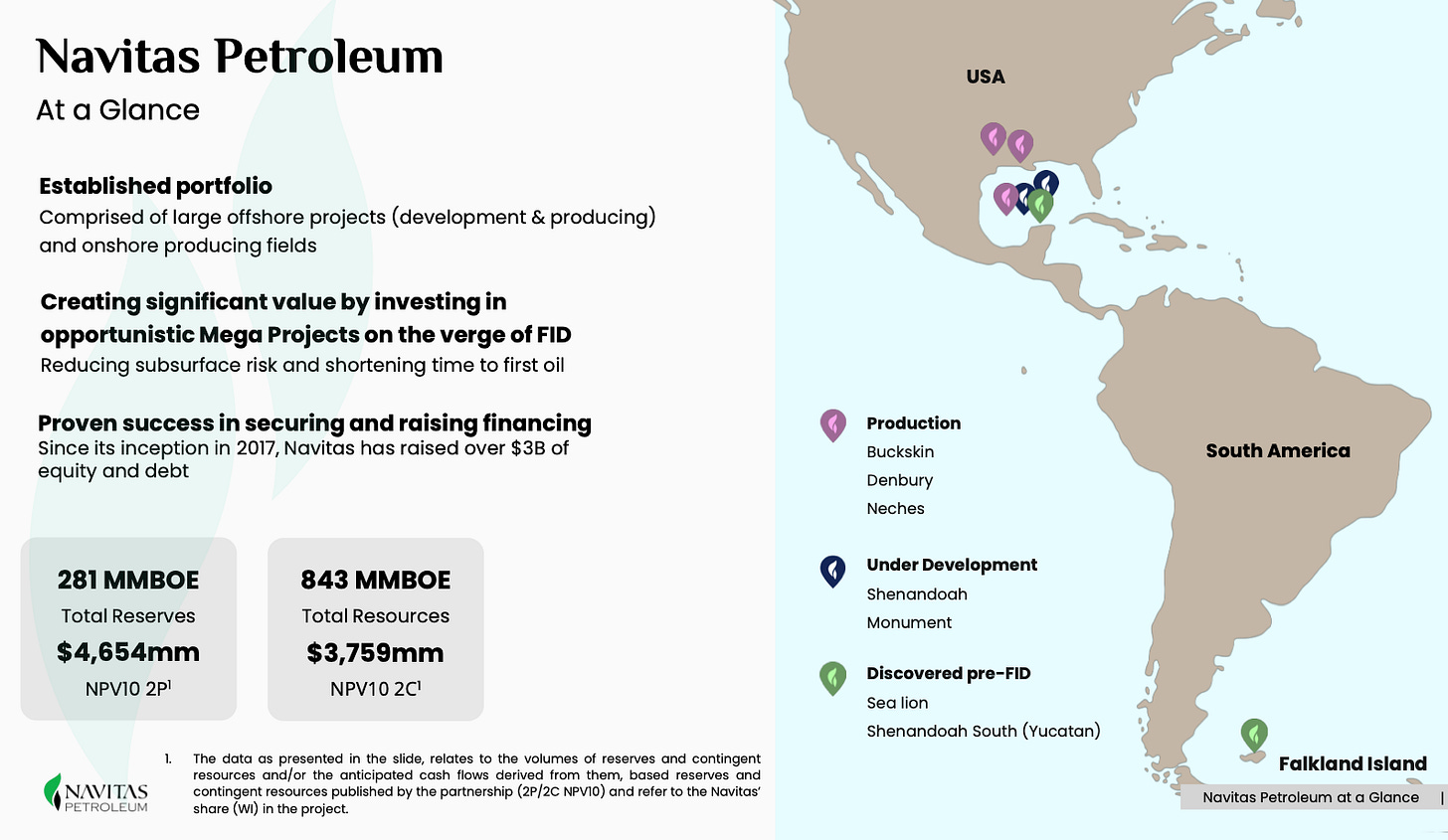

Navitas is a rapidly growing Israeli exploration and production (E&P) company with a proven track record and a robust balance sheet, able to handle most of the initial investment requirements. The company has experienced significant growth, increasing its resources from 201 million barrels of oil equivalent (mmboe) in 2019 to 1,124 mmboe in 2024, (459% rise). Navitas holds both majority and minority interests in several large projects located primarily in the Gulf of Mexico, the Falklands, and the State of Texas.

The company benefits from strong leadership that brings extensive experience to Rockhopper’s first major project:

Gideon Tadmor (Chairman) — one of founders of O&G in Israel, with over 20 years of experience in leading developments worldwide. Gideon led the successful development of the Yam Tethys project, Israel’s first producing natural gas reservoir discovered in 2000.

Amit Kornhauser (CEO) — Navitas insider since 2013, with two decades of experience in the sector and several successful tenures in Delek Energy (CFO & Controller), Aura Investments (Controller). He is largely responsible for the recent growth of Navitas and becoming a large sized player.

They will be joined by Rockhopper's CEO, Sam Moody, a co-founder of Rockhopper who has been instrumental in building and managing the company since its formation in early 2004. Sam has also worked in various roles within the financial sector, including positions at AXA Equity & Law Investment Management and St. Paul’s Investment Management.

More details on Rockhopper’s and Navitas Petroleum’s leadership are available here: RKH, NVPT.

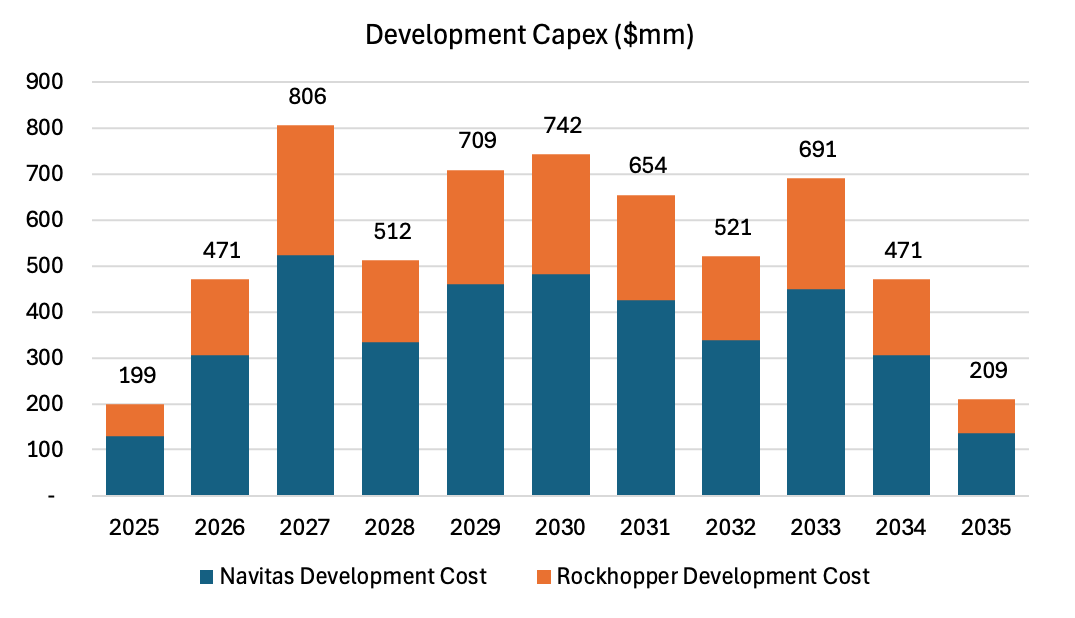

Capex & Zero-Interest Financing

All three phases of the Sea Lion project are expected to cost approximately $4bn, with the phase 1 projected to cost between $1.50bn and $1.75bn. The remaining 2nd and 3rd phases are expected to cost between $2.25bn and $2.50bn.

In addition to this capex, NSAI report for Navitas suggest plans to spend an additional $2bn on further phases and drilling new wells to fully extract the potential resources from the field. This brings the total development cost for Sea Lion to ~$6bn over the next decade.

The costs will be split based on the working interest (35% for Rockhopper and 65% for Navitas), meaning our company of interest would be responsible for over $2bn of the total project cost, including ~$0.5bn to $0.6 billion for phase 1.

Rockhopper recognizes that it does not have the financial capacity to fund such a substantial development like Sea Lion independently. Instead of accruing significant debt while holding onto undeveloped resources, a more prudent strategy is to establish a joint venture (JV) with a larger, more experienced partner.

This is where Navitas comes into play. In exchange for a 65% working interest in the project, Navitas will provide almost all of the necessary capital at a 0% interest rate, with Rockhopper required to contribute a small equity portion based on the final cost of phase 1:

$1.25bn Capex: ~$64m equity needed from Rockhopper

$1.50bn Capex: ~$70m equity needed from Rockhopper

$1.75bn Capex: ~$88m equity needed from Rockhopper

For our assumptions, we will consider a base case of ~$70 million provided by Rockhopper.

The borrowed amount will be repaid to Navitas at a maximum of 85% of Free Cash Flow per year until the full amount is returned, which should be around 2031.

In summary, with a 65% working interest, RKH gains a partner who has experience in large-scale developments, offers a relatively quick investment commitment compared to other options (shorter wait time for oil production), and provides the most affordable funding available... not bad.

Further details regarding funding will be available with the Final Investment Decision (FID), which is expected in the second half of 2025. The current deadline for the FID is set for September of this year.

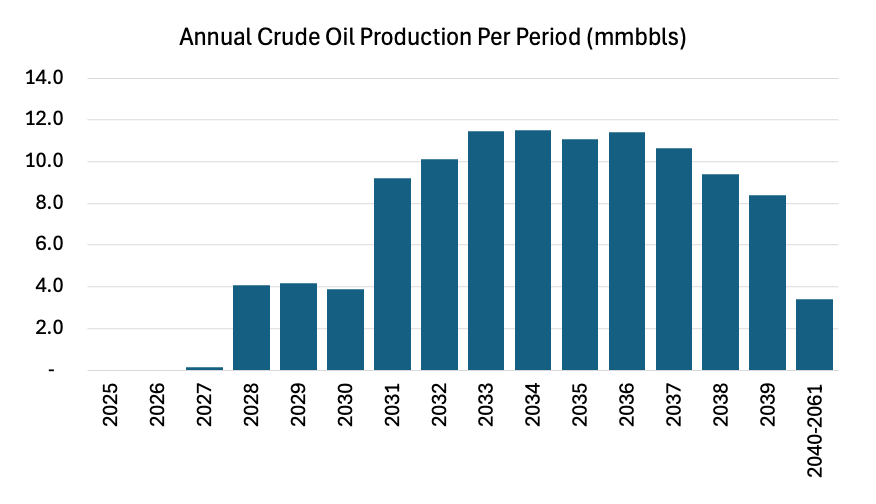

Strong Production Profile & Potential Upside From New Developments

We used the latest NSAI report for Navitas as the basis for our model. Due to the underestimation of the Sea Lion Project and indications from Navitas and Rockhopper’s management that there is still more oil than documented, we applied a +10% adjustment to the volume extracted per year. On the other hand since we are talking about 2C (contingent resources) not 2P proven reserves (viable for exploration) we assume only 77% of the resources oil will be extracted (based on Navitas projections).

As a result, Rockhopper’s production is expected to grow rapidly over the next few years, starting in 2027. In the first full year of production, 2028, the company is projected to produce ~4 mmbbls. This production is expected to increase to ~9 mmbbls by 2031 and peak at ~12 mmbbls in 2034.

For some readers, the decline in production after 2034 may come as a surprise. However, it is important to note that additional investments will be necessary over the coming decades to fully tap into Rockhopper’s 321 mmbbls worth of Sea Lion resources.

If Rockhopper were to maintain its peak production rate, the 2C resources were proven to be 2P over time, Sea Lion could support continued production for 23 years beyond 2034, totaling 30 full years of oil production from Sea Lion (from 2028 to 2057).

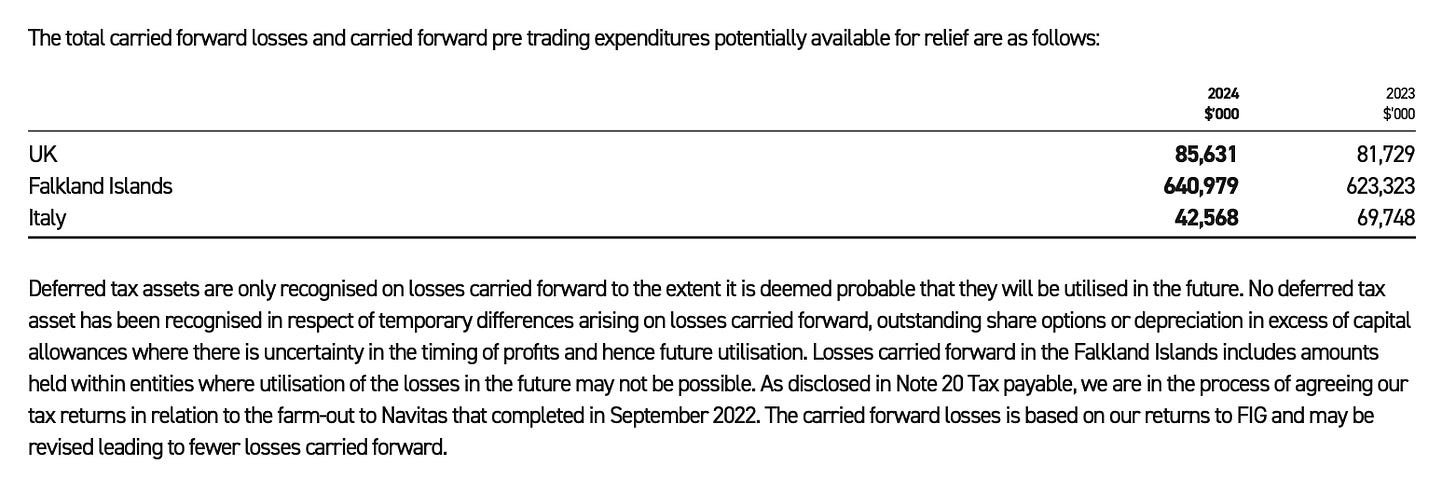

Significant Tax Assets to Shield Rapidly Growing Income

Rockhopper has accumulated losses totaling $641mm over two decades of exploration in the Falkland Islands. These tax assets will be used to offset the increasing income expected in the coming years, significantly enhancing profits that are typically taxed at 26%. These should come in handy especially during the period when Rochopper will be repaying Navitas.

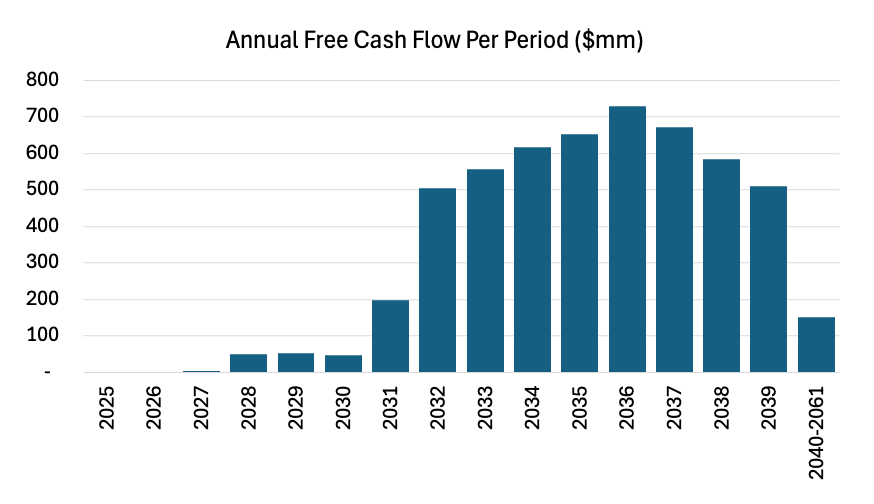

Strong Cash Flow Coming

We base our forecast for Sea Lion's free cash flow (FCF) on the capex and production mentioned above. For realistic simplicity, we assume an average crude oil price of $70/barrel. This estimate is slightly below the current price of around $75, which has spiked due to the recent conflict between Israel and Iran.

We believe that applying any oil price forecasts for Rochopper will be unreliable, as the investment horizon for this thesis is relatively long, and we will have to wait over two years to see the first cash flows from Sea Lion.

That being said, even if we crosscheck our assumed price with the Brent Crude Futures Curve we are only $2/bbl above the implied long-term price, so let;’s round up to $70 :D

Although Sea Lion is expected to be a cash-printing project, Rockhopper will receive only ~$50mm per year until 2031 ( when additional drilling translates to production increase and Navitas is fully paid down). This will occur as additional drilling leads to an increase in production and Navitas is fully paid off. As the loan is repaid, the company will enhance its FCF yield, operating at ~45% starting in 2032. Later It is expected to grow to 60% as all 3+ phase capex is committed.

NAV Valuation

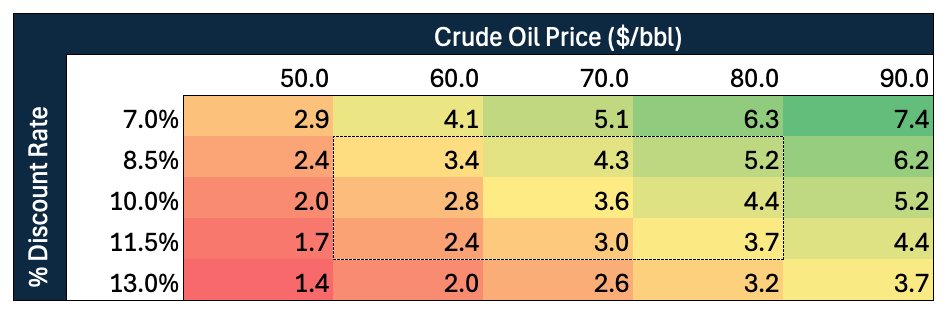

Our valuation method of choice for Rockhopper is Net Asset Value (NAV) approach. Using the cash flow above and conservative 10% discount rate we estimate the company’s NAV at $2.3bn. It gives us $3.60/share NAV which compared to the US dollar-denominated share price of $0.63/share indicates an 82.5% discount to NAV and a 4.7x potential upside…

For easy tracking of the changes in NAV based on two main drivers — oil price and discount rate — please see the NAV/share sensitivity table below

DCF Valuation

To cross-check NAV-based valuation was also used DCF. In essence, almost all assumptions are the same except the discount rate used. WACC (our discount rate) was estimated at nearly 8%.

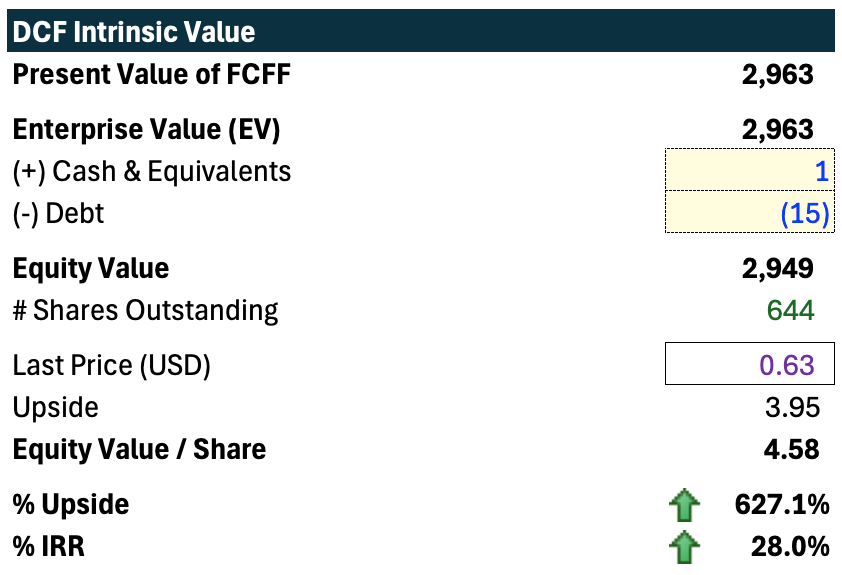

Using these metrics, we calculated the Enterprise Value to be approximately $3.0bn. After subtracting $14mm of net debt (total debt minus cash) and dividing the Equity Value by the number of shares outstanding, we determined a target price of $4.58/share. The current share price of $0.63 implies a potential ~6.3x upside…

Key Risks:

Delays of Final Investment Decision

Delays in drilling and production timeline

Capex spending growing beyond budget

Low long-term crude oil prices

We had to simplify many things and if we made any mistakes, we are sorry and encourage you to correct us :) If you enjoyed this publication please like and comment! It would mean a great deal to us and help grow our research blog!

Disclaimer

The information contained on this website is not and should not be construed as investment advice and does not purport to be and does not express any opinion as to the price at which the securities of any company may trade at any time. The information and opinions provided herein should not be taken as specific advice on the merits of any investment decision. Investors should make their own decisions regarding the prospects of any company discussed herein based on such investors’ own review of publicly available information and should not rely on the information contained herein.

The information contained on this website has been prepared based on publicly available information and proprietary research. The author does not guarantee the accuracy or completeness of the information provided in this document. All statements and expressions herein are the sole opinion of the author and are subject to change without notice.

Any projections, market outlooks or estimates herein are forward looking statements and are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur. Other events that were not taken into account may occur and may significantly affect the returns or performance of the securities discussed herein. Except where otherwise indicated, the information provided herein is based on matters as they exist as of the date of preparation and not as of any future date, and the author undertakes no obligation to correct, update or revise the information in this document or to otherwise provide any additional materials.

The author, the author’s affiliates, and clients of the author’s affiliates may currently have long or short positions in the securities of certain of the companies mentioned herein, or may have such a position in the future (and therefore may profit from fluctuations in the trading price of the securities). to the extent such persons do have such positions, there is no guarantee that such persons will maintain such positions.

Neither the author nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein. In addition, nothing presented herein shall constitute an offer to sell or the solicitation of any offer to buy any security.

External links, if any, may redirect you to a privately-owned web page or site (“site”) created, operated, and maintained by a third party, which may not be affiliated with Alpha Ark. The views and opinions expressed on the site, other than those presented by Alpha Ark, are solely those of the author of the site and should not be attributed to Alpha Ark. We have not verified the information and opinions found on the site, nor do we make any representations as to its accuracy and completeness as to the third-party information. Further, Alpha Ark does not endorse any of the third-party’s products and services or its privacy and security policies, which may differ from ours. We recommend that you review the third-party’s policies, terms, and conditions to fully understand what information may be collected and maintained as a result of your visit to this website.

Great writeup! What do you think about the risk of capex overrun?