Valeura Energy (VLE.TO) - Thesis Update

After 20% stock appreciation, operational and financial updates, 2025 guidance release, and changes in macro, we take a fresh look at Valeura

Summary:

Valeura Energy is one of our top picks for the year. It is a fast-growing upstream Oil&Gas company that has become Thailand's second-largest crude oil producer within just three years.

Since the end of 2023, its production has increased by approximately 42%, rising from 20.4 to 28.5 mmbbls/d. The company continues to expand staying extremely profitable with ~28% free cash flow to the firm (FCFF) margin.

Recently, Valeura released its operational and financial updates for 4Q24. These results were largely in line with our expectations for the year. The company has generated impressive cash flow, increasing its cash position to $259mm, and remained debt-free.

Additionally, Valeura provided guidance for 2025 that, although slightly conservative, still indicates strong fundamentals for the equity story. We expect total crude oil production to reach approximately 9.3 mmbbls for 2025, representing a 12% year-over-year (YoY) increase. We anticipate EBITDA and Free Cash Flow to Firm (FCFF) will grow to $347mm and $172mm, respectively.

Recent sanctions against Russia’s “shadow fleet” and a harsh winter in Europe and the United States have put pressure on crude oil prices. As a result, Brent oil has risen by 8% compared to our initial projections for 2025.

Despite a 20% appreciation in the stock since our initial publication, it remains extremely undervalued, trading at 0.9x EV/EBITDA, 1.8x EV/FCF, and 3.3x P/FCFF for 2025. In contrast, industry peers trade at ~3x higher multiples, implying ~181% upside for Valeura.

In our discounted cash flow (DCF) model, we have revised our long-term production and capital expenditure (capex) forecasts to be more precise and conservative. This adjustment is the primary reason our intrinsic value estimate has declined by ~19% to $16.22 despite the increase in short-term oil prices. Nevertheless, Valeura continues to appear extremely undervalued, with an upside of ~196%.

We believe the reserves update scheduled for February could significantly boost the stock. Given the recent spike in production from the Jasmine field, indications of higher reserves from Wassana, and drilling at Manora, investors could be positively surprised.

Download Our Model

Where are we now?

It has been more than a month since we published our deep dive on Valeura Energy (VLE.TO). Since then, the stock has appreciated ~20%. The company released its operations update for 2024 and provided guidance for 2025. Furthermore, there have been significant macroeconomic changes that have led to a rise in the Brent curve in the near term. We have also taken a deeper look at Valeura, gaining additional insights into this equity story and the company’s prospects.

This guidance is solid, and while we believe some areas may be conservative, we feel this cautious approach is warranted, especially given the rapidly increasing rates in the E&P sector.

2024 Operational and Financial Update

On January 8th, the company released Its operational and financial update for 2024. We summarized key points below:

Oil production during the quarter averaged 26.1 kbbls/d (36% YoY) and full-year production averaged 22.8 kbbls/d (43% YoY)

2.95 mmbbls of oil sold in Q4 2024, with 8.35 mmbbls for the full year 2024

Valeura generated US$226mm revenue for the quarter and US$679mm for the whole year

The company didn’t pay any taxes during the 4Q24 due to the outstanding NOLs

Thanks to no taxes paid for the quarter and record-high production It generated US$259mm in cash and ended the year debt-free

The company bought back 348k shares in Q4

These results are largely in line with our estimates. Although we overshot on some metrics and Valeura outperformed on others, the overall net impact on cash flow is positive.

Based on these figures, we expect Valeura to generate a free cash flow to the firm (FCFF) yield of over 28% last year. With an operating expense (Opex) of just US$26/bbl for the 2024 year and similar levels next year, It is on track to continue generating cash at similar levels. We believe this profitability offers solid downside protection in case of adverse macroeconomic conditions.

2025 Guidance

Now let’s discuss some of the key points from the yearly guidance:

Valeura expects full-year oil production of 23–25.5kbbls/d (1-12% YoY)

In our initial write-up, we projected slightly higher production for the year. However, companies generally underestimate key metrics to manage expectations and then later raise guidance. Thus, in our updated valuation, we will adjust our expectations to the top of the guided range.

Capex of US$125–150mm

In our initial analysis, we estimated capex based on previous high efficiency, but rising oil prices and increased demand for exploration and production (E&P) services may lead capex to align with the company’s estimates. We conservatively assume the mid-range for our projections of maintenance and growth capex going forward.

Adjusted Opex of US$215 – 245 million

Depending on total yearly production, this implies an Opex range of US$25.6 - US$26.3/bbl. We’re still waiting for 2024 actuals, but we can use last year's guidance provided with 3Q24 results to compare to our 2025 projections. Valeura expected US$205-235mm Opex last year, implying US$24.6 - US$28.1/bbl. In our model, we use US$26/bbl for 2024 and assume a slight cost reduction this year.

This is strong guidance, even though we believe in some areas it could be rather conservative. Nontheless we think there’s room for a positive suprise for investors.

Macro Becomes Even More Favorable

Since we released our thesis, several new developments have driven short-term Brent futures higher, which is the main benchmark for Valeura’s realized price:

The US government imposed sanctions on Gazprom Neft and Surgutneftegas, primarily targeting the "shadow fleet"—aging tankers used to transport Russian crude to India and China. Since the onset of the Russo-Ukrainian war in 2022, this has become a critical method for shipping Russian oil. Goldman Sachs estimates that the vessels affected by these sanctions transported 1.7 mmbbls/d in 2024, accounting for roughly 25% of Russia's exports.

Goldman Sachs has recently raised its projections, with a Brent range target of $70-$85 per barrel, and an average of ~$76 for 2025. Since then, futures have grown to ~$77 per barrel for this year.

Harsh weather conditions in Europe and the United States are driving winter oil demand higher, with several blizzards affecting both continents. An arctic cold front is expected next year, likely leading to further temperature drops.

According to JP Morgan, for every degree Fahrenheit, the temperature falls below its 10-year average in the USA, Europe, and Japan, and heating oil and propane demand increases by 113 kbbls/d. The first factor (sanctions) is expected to tighten supply, while the second (low winter temperatures) is likely to boost demand expectations. These two trends are partially countered by the signing of a ceasefire in Gaza, which could lower shipping costs for tanker operators because of halt of the Houthi attacks.

Valuation Update

With the 2024 update discussed, 2025 guidance covered, and bitting into recent macro developments let us now see what changes in our valuation. We will go through our DCF and Peers Multiples calculations that we used in the original wirte-up.

Higher Crude Oil Price

Our model is based solely on the futures market. Since the publication of our original write-up, Brent prices in the short and mid-term have noticeably increased, rising by 8%, 4%, and 2% in 2025, 2026, and 2027, respectively.

Beyond 2027, there are minimal differences in the Brent curve, with 2028 and 2029 futures being 1% higher than initially expected. The long-term price stabilizes at $68.10/bbl by 2030.

Production Forecast

We made some noticeable changes to our production forecast to make it more precise and realistic. Previously, for simplification, we assumed a relatively stable production profile, with the understanding that some reserves would be depleted and gradually replaced. However, to provide a clearer perspective, we decided to illustrate what the actual replacement scenario could look like.

In February, Valeura will provide an oil reserves update, but for now, we have to use 2023 numbers as a reference. At the end of 2023, the company had ~37.9 mmbbls 2P (Prooved & Probable) and 46.5 mmbbls 3P (Proved, Probable, and Possible) reserves. By subtracting 2024’s production, we end up with 29.6mm and 38.2mm of 2P and 3P reserves, respectively. At the current annualized production these reserves would be enough for 3.5 and 4.5 years of operations respectively.

However, we already know that Wassana and Jasmine's fields have significantly larger reserves based on initial assessments of the Wassana field and last year’s drilling results at Jasmine. Additionally, management believes the life cycle of the Manora field could be extended further.

Given this information, we believe that even with a slow increase in production, the company could extract a few more operational years from its fields. Excluding the highly reserve-rich Wassana, we estimate these fields could continue operating at full capacity for an additional 2.5 years (as far as 2029).

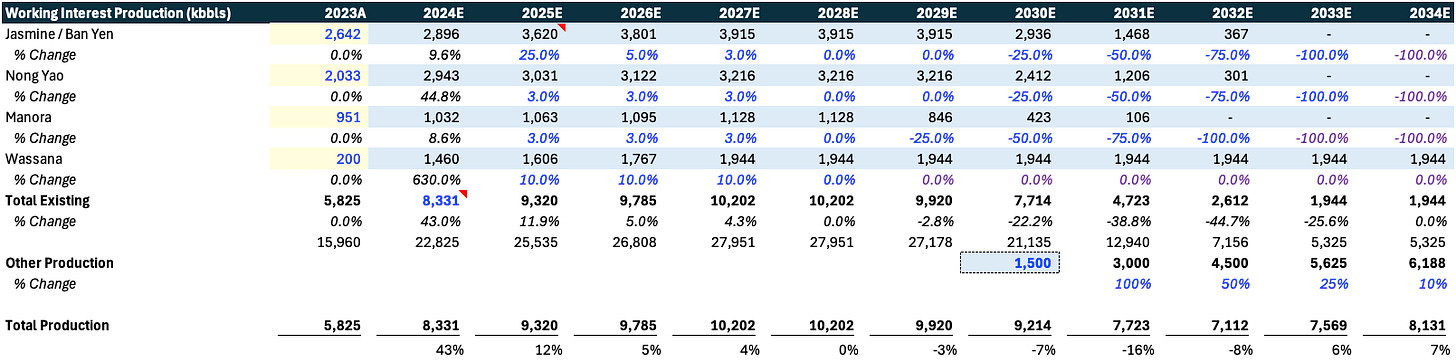

Production Forecast by Field (kbbls/y)

Based on our analysis, we project production to increase from 2025's forecast of 9.5mmbbls/y (the top of the guided range) to approximately 10mmbbls/y by 2027. After that, production is expected to decline to around 7mmbbls/y by 2032, before climbing again to about 8mmbbls/y due to new production outside of the existing fields.

Despite the company having nearly a 2x Reserve Replacement Rate (RRR) and targeting over 1x RRR in the future, a decline in total production is still anticipated, which we consider rather conservative. Particularly when we take into account how Valeura’s team has demonstrated their ability to prolong field life and increase production several times (most notably in the Manora and Jasmine fields).

Yearly Production Forecast Breakdown (kbbls/y)

When preparing this write-up, we asked ourselves: What if the company is unable to discover new sources of oil and has to rely solely on the existing fields? Using the production forecast above and assuming no new production fields, the company still presents approximately a 127% upside, targeting nearly CAD$18 per share. That’s what we call a great margin of safety!

Margin Forecast

IIn our model, we assumed that contracting margins are primarily driven by declining crude oil prices and increasing operating expenses (OPEX) starting in 2027. Royalties are projected to grow from 12.0% in 2024 to 13.5% in 2026, stabilizing afterward.

As a result, we forecast a margin decline from ~$41.4/bbl in 2025 to ~$31.9/bbl in the terminal year. This translates to a decrease in gross profit margins from oil production, falling from 53.7% in 2024 to 46.8% in the terminal year.

Gross Profit Per Barrel Breakdown ($)

Capex Forecast

For growth stories like Valeura, capital expenditures are a crucial cost of doing business. In our initial publication, we assumed historical capex expenses based on an estimated historical split between maintenance and growth capex. However, based on the 2025 capex guidance of $125-150mm and the anticipated production growth this year, we believe the actual capex spending per barrel for new and existing production could be higher, particularly regarding maintenance capex.

We assumed a 70-30 split between maintenance and growth capex for 2025, using the midpoint of the capex guidance of $137.5mm (compared to our previous estimate of $101mm). Based on this, we project $96 million and $41mm in maintenance and growth capex for 2025, respectively. For 2025, we expect maintenance capex of $11.6/bbl and growth capex of $41.7/bbl. In our base case, from 2026 onward, we expect capex per barrel to grow at 2% year-over-year.

Capex Breakdown ($mm)

By factoring in our need for new production to replace existing fields and forecasting growth in maintenance capex spending per barrel of new and existing production, we estimate approximately $129mm in capex peaking at $167mm in 2030, followed by a decline to $152mm in the terminal year.

Results

We anticipate declining gross profit margins, falling from 64.2% in 2024 to 54.1% in the terminal year. However, due to the fluctuating capex spending, the free cash flow margin is more volatile. We expect it to grow from 28.2% in 2024 to 25.3% in 2029, then contract to just 7.7% in the terminal year (primarily due to capex).

Free Cash Flows ($k)

For exit multiple, we assumed 5.6x EV/EBITDA, in line with the upstream businesses. For discounting cash flows we used the current WACC of 9.25%. Based on these metrics we arrived at the Enterprise Value of ~$1.4bn. After adding ~$259.4mm of cash on the books and dividing it by the number of shares outstanding we arrive at US$16.22/share target price (CA$23.44/share). The current share price of US$5.47 (CA$7.92/share) implies ~196% upside…

Despite slighly higher crude oil prices our intrinsic upside is lower than what we projected in our initial deep dive primarily due to:

~20% appreciation of the share price

lower production assumptions

higher share of growth capex which is nearly 4x higher per bbl of new production than matinenace capex per existing barrel of production

higher WACC

DCF Summary ($k)

Scenario Analysis

To flex our assumptions we run a sensitivity analysis. We prepared Bull and Bear cases by tweaking key metrics in the projection period. These include:

Avg. Brent price

Avg. GP margin per bbl

Avg. growth capex per bbl change

Avg. maintenance capex per bbl change

With these assumptions, we were able to estimate Valeura’s share price under different scenarios. It ranged from US$12.96 in the bear case to $18.95 in our bull case. This range could be thought of as our intrinsic value estimate.

Multiples

Similarly to our DCF, multiples scream “undervalued!” as the company is trading at 2025E's 0.9x EV/EBITDA, 1.8x EV/FCF, and 3.3x P/FCFF. For comparison, we can use Asia and Australia-focused E&P players like Beach Energy and Woodside Energy.

Our preferred multiple is EV/EBITDA because it is the most popular and universally applied across the Oil & Gas Industry. Beach Energy and Woodside Energy have NTM EV/EBITDA of 3.7x and 3.9x, respectively. These mean that Valeura is nearly 4x cheaper. The market cap weighted average EV/EBITDA multiple is 3.9x (due to the relatively large size of Woodside Energy), suggesting a share price of US$15.39/share and ~181% upside.

We think this combined with DCF upside is exceptional and could outweigh potential risks associated with the upstream business.

Disclaimer

The information contained on this website is not and should not be construed as investment advice and does not purport to be and does not express any opinion as to the price at which the securities of any company may trade at any time. The information and opinions provided herein should not be taken as specific advice on the merits of any investment decision. Investors should make their own decisions regarding the prospects of any company discussed herein based on such investors’ own review of publicly available information and should not rely on the information contained herein.

The information contained on this website has been prepared based on publicly available information and proprietary research. The author does not guarantee the accuracy or completeness of the information provided in this document. All statements and expressions herein are the sole opinion of the author and are subject to change without notice.

Any projections, market outlooks or estimates herein are forward looking statements and are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur. Other events that were not taken into account may occur and may significantly affect the returns or performance of the securities discussed herein. Except where otherwise indicated, the information provided herein is based on matters as they exist as of the date of preparation and not as of any future date, and the author undertakes no obligation to correct, update or revise the information in this document or to otherwise provide any additional materials.

The author, the author’s affiliates, and clients of the author’s affiliates may currently have long or short positions in the securities of certain of the companies mentioned herein, or may have such a position in the future (and therefore may profit from fluctuations in the trading price of the securities). to the extent such persons do have such positions, there is no guarantee that such persons will maintain such positions.

Neither the author nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein. In addition, nothing presented herein shall constitute an offer to sell or the solicitation of any offer to buy any security.

External links, if any, may redirect you to a privately-owned web page or site (“site”) created, operated, and maintained by a third party, which may not be affiliated with Alpha Ark. The views and opinions expressed on the site, other than those presented by Alpha Ark, are solely those of the author of the site and should not be attributed to Alpha Ark. We have not verified the information and opinions found on the site, nor do we make any representations as to its accuracy and completeness as to the third-party information. Further, Alpha Ark does not endorse any of the third-party’s products and services or its privacy and security policies, which may differ from ours. We recommend that you review the third-party’s policies, terms, and conditions to fully understand what information may be collected and maintained as a result of your visit to this website.

Good update Alpha Ark! I Like your approach a lot - keep up the good work